Insight Perspectives

Insight Perspectives

10

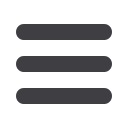

well aware that the mainland needs to move up the

value ladder, which requires a ”moderately overvalued”

currency. The current downturn in the manufacturing

sector, however, has proved more severe than

expected. There are no signs yet of an upcoming

rebound in manufacturing activity, surely not as long as

excess capacity remains a problem in many industries -

read the Xinhua article,

China to tackle industrial overcapacity .In December, a report showed that

cargo handled at major seaportscontracted at the fastest

pace since March 2009;

cargo handled by rail(November 2015) declined at the fastest rate ever seen.

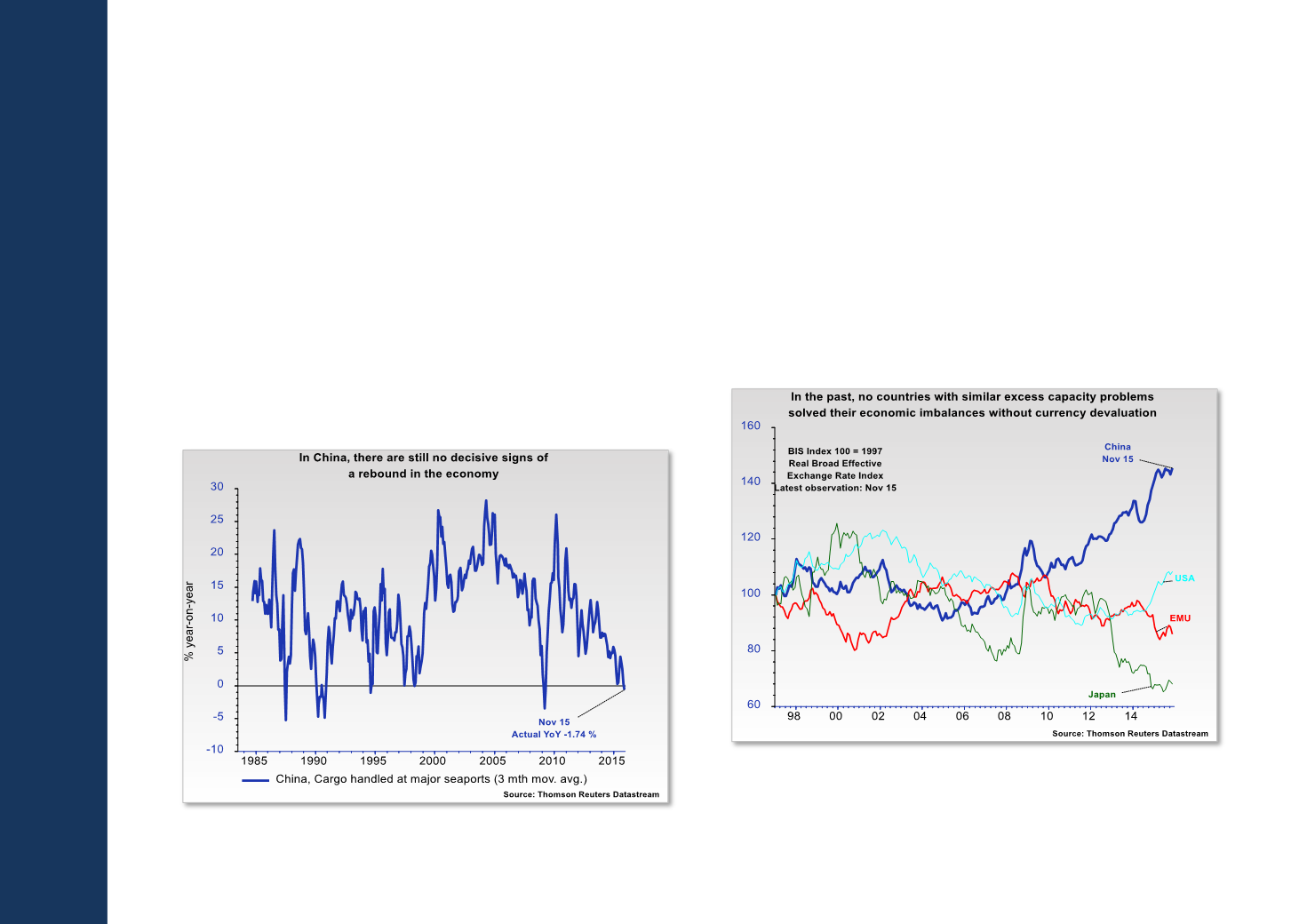

Weakness in the manufacturing sector is now so severe

that Beijing seems inclined to act more aggressively.

The domestic economy needs more monetary easing,

which is only possible if the Chinese central bank, PboC,

allows an overvalued yuan to depreciate more

significantly (read the Insightview article,

The Chinese dilemma - something needs to give in ). This was also

why Chinese policymakers allowed the yuan to

continue depreciating against the US dollar in

December even though the euro appreciated.

In 2016, Beijing will stay on a path of further

devaluation, which could pull the yuan down to 7.0

against the US dollar – see the

2016 Outlookon page