Insight Perspectives

Insight Perspectives

5

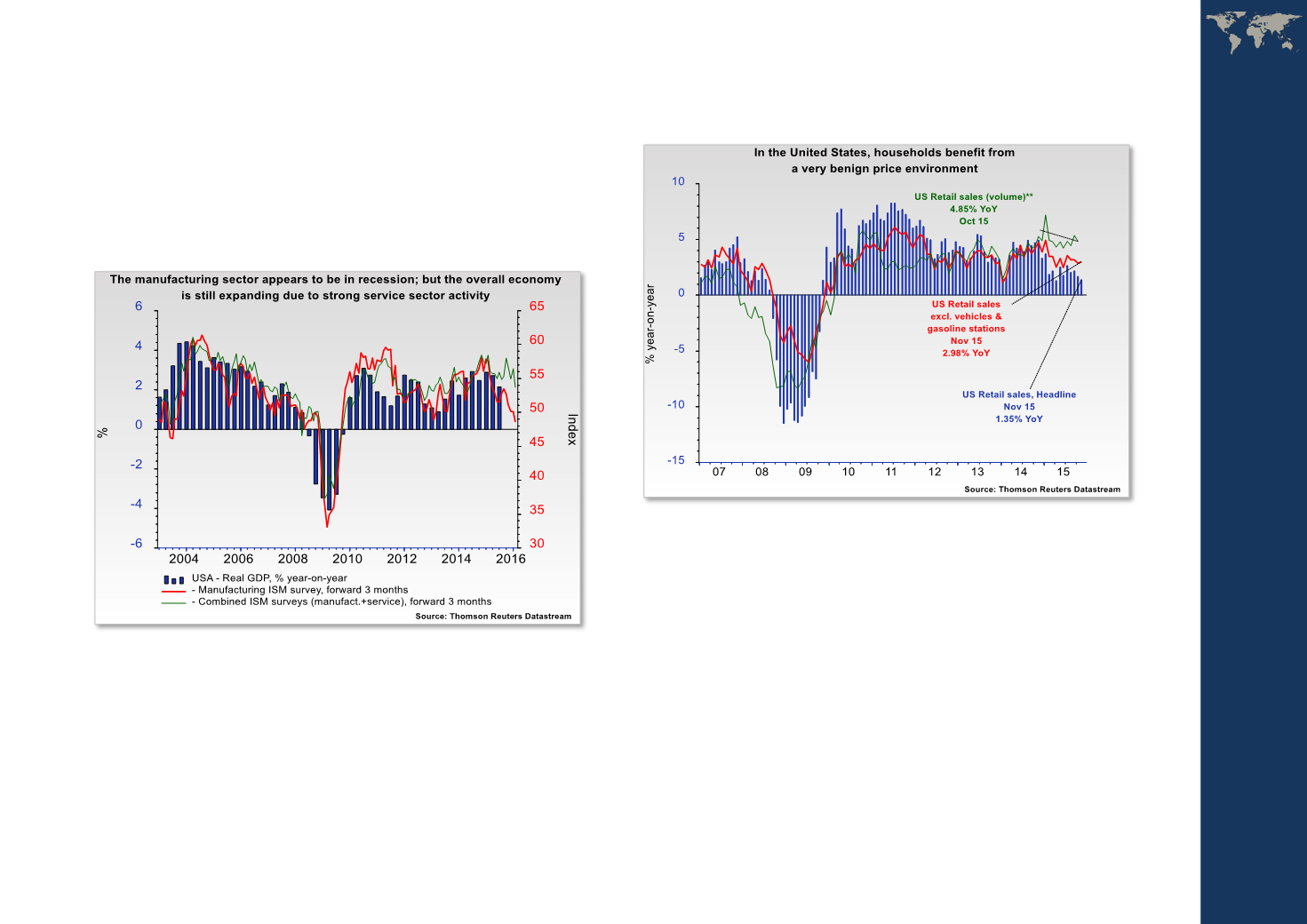

weaknessin the last few months. In November,

retail sales in volume terms rose close to 5% year-on-yearand consumer sentiment remains upbeat – read the

Insightview article,

US December consumer sentiment stays upbeat as fear of terrorism fails to dent sentiment .At present, US households are exposed to multiple

tailwinds: inflation is low, the

labour market is strongand there are tentative signs of stronger wage

increases in the pipeline. The latter was also reflected

in the firms'-compensation-plans-index in the leading

small business sentiment survey(NFIB); the index

jumped in November to the highest level since 2006.

These factors will make it difficult for Federal Reserve

Chairman Yellen not to hike policy rates yet again in

March. Granted, higher policy rates will make the

yield curveflatten more aggressively in the first quarter of

the new year, which is a harbinger of slower growth

later in 2016. The latter is the case as this time the

economy will prove far more sensitive to changes in

monetary policy than in the past.

In December, the yield curve prediction was also

supported by the fact that the six-month-outlook index

in the

regional Philadelphia Federal Reserve survey fell