Insight Perspectives

Insight Perspectives

12

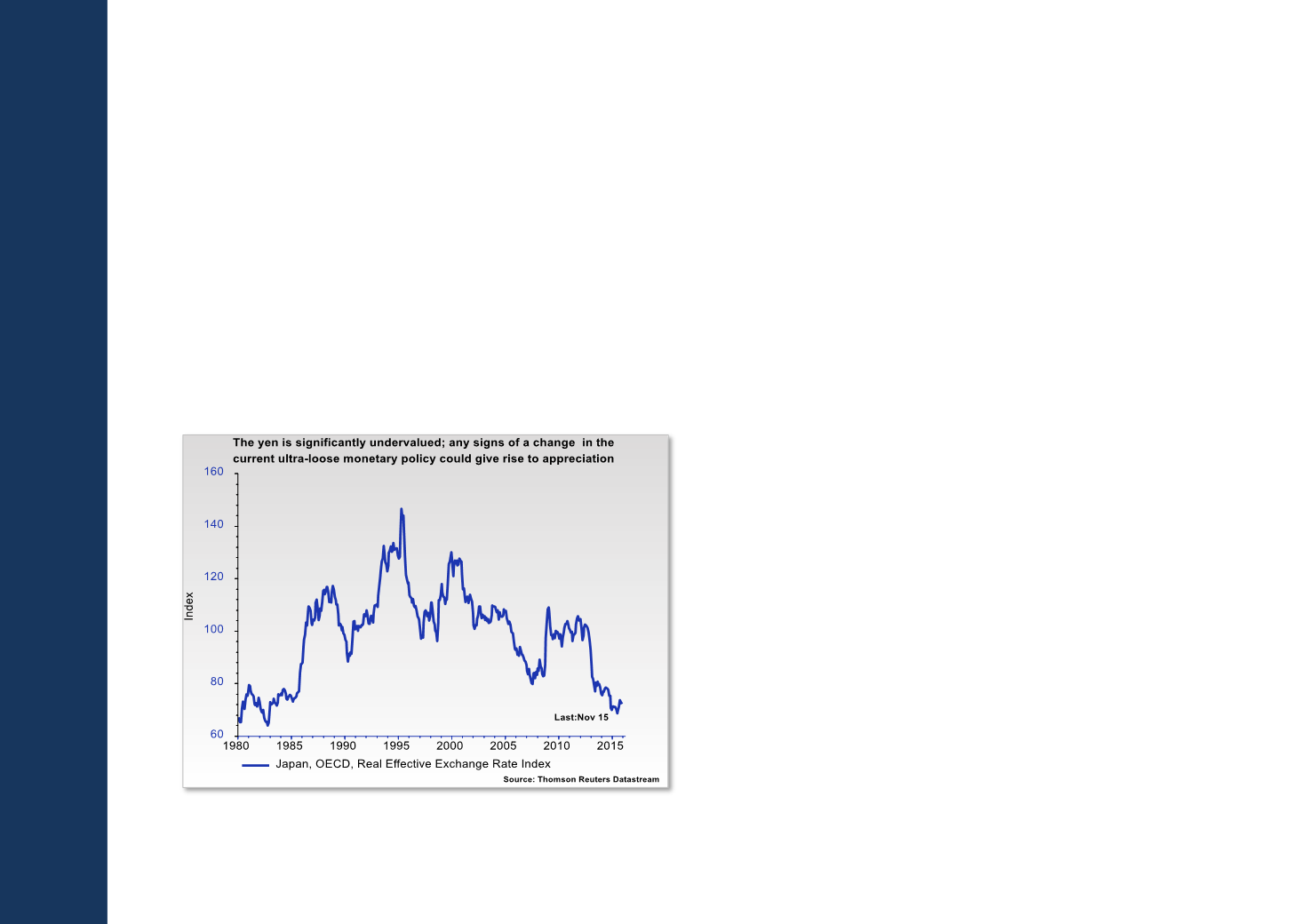

Japan – Weak yen is no longer seen as panacea to

solve economic imbalances

In Japan, Abenomics was supposed to weaken the yen

and boost exports. The problem, however, is that

global demand is slowing and Japanese exporters have

no intention of reducing export prices denominated in

foreign currency. Instead, they used a weaker yen to

book a windfall profit. In November,

Japanese exports fell 3.3% year-on-year in yen terms ,which was the

biggest decline since Prime Minister Abe took office in

December 2012.

Japan is in a highly difficult situation. It is pretty obvious

that a weaker yen will do no good to the economy, at

least this seems also to be the conclusion according to

an increasing number of voting members at the Bank of

Japan – read the Japan Times article,

BOJ adjustments signal limits to monetary easing .The decision by the

US Federal Reserve to raise policy ratesalso reduces the

need to raise the current level of money-printing in

Japan as this may help keep the yen heavily

undervalued for a little longer.

The yen, however, may be headed for abrupt

appreciation. This will be the case if the Bank of Japan

abstains from introducing additional monetary stimulus

measures; this is simply a necessity to keep the

currency significantly undervalued. In 2016, the

yen,however, may be exposed to more appreciation

factors. This is not least the case if the financial market

moves into a risk-off environment in the first quarter,

which is part of this newsletter’s

2016 Outlook ;this

could reinforce yen repatriation. Ironically, the biggest

appreciation factor is if the Japanese economy is

responding to

Abenomics .This would leave the Bank of

Japan empty-handed when it comes to arguing for

more monetary easing; good news simply risks

becoming bad news.