Insight Perspectives

Insight Perspectives

13

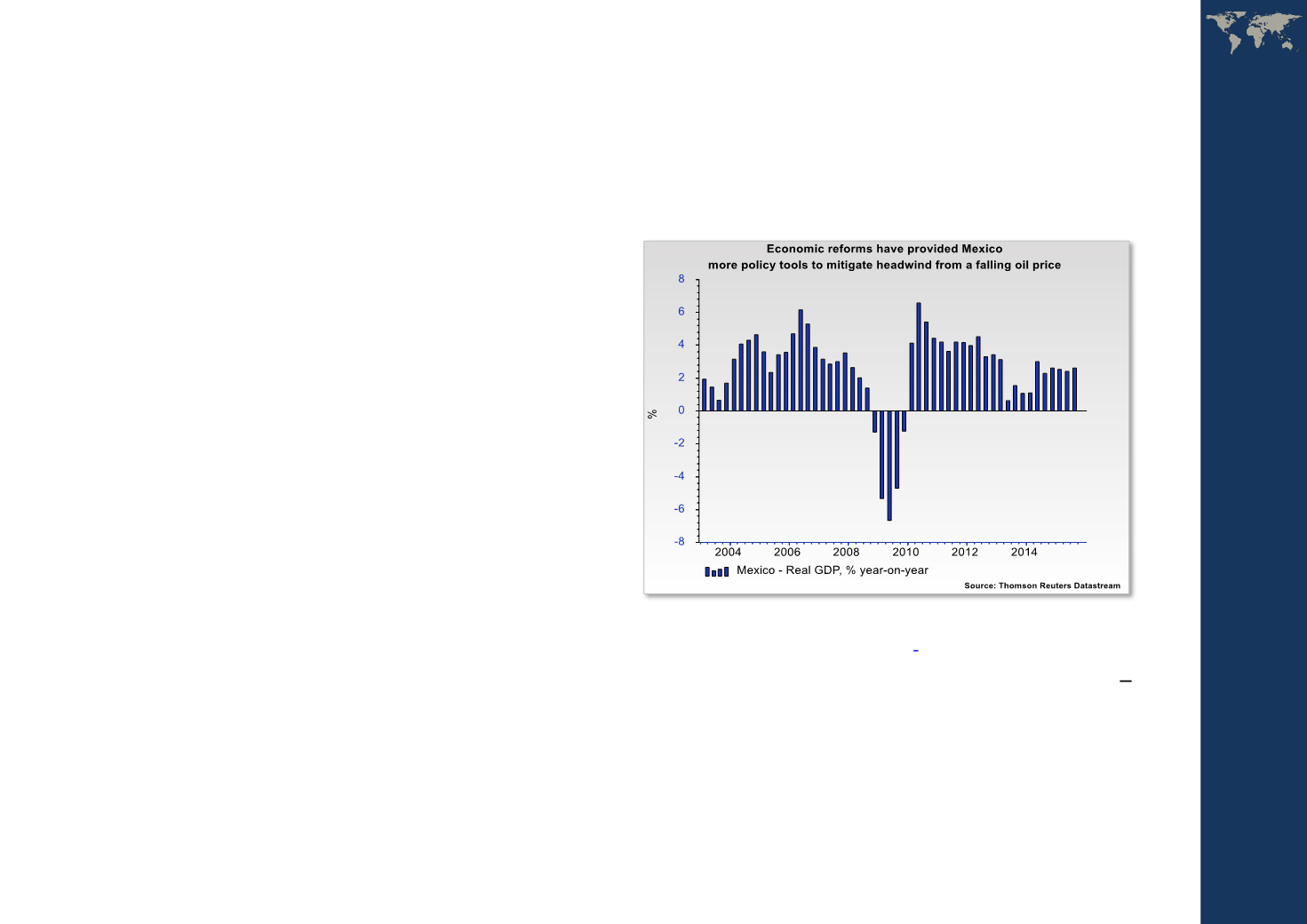

Mexico - Reform process provided more tools to

mitigate global headwind; but this may no longer

be enough

In 2015, the Mexican central bank has been

preoccupied with adding liquidity as the economy has

seen headwind from a falling oil price. So far, the

strategy has been relatively successful simply

because

Banxicohas to a large extent ignored a

declining peso, at least until recently. This has only

been possible because inflation has been relatively

well-behaved, which has to be credited to a reform-

minded government. In the last few years, Mexico

implemented bold structural reforms, which made

the Mexican economy far more flexible compared to

the

Brazilian economy .Mexico’s improved economic credibility has provided

policymakers with more tools to mitigate the impact of

external shocks. Lately, the fiscal deficit has increased

partly because one-third of fiscal revenues are oil-

related. This, however, has not been punished by the

financial market, at least not to the same extent as in

the past. In 2015, Mexico has been able to show steady

growth. On the other hand, the current account deficit

is on the rise and Mexico’s international reserves are

declining. This has also gained the attention of the

foreign exchange market. Many investors are now

speculating against the peso, not least because policy

rates are relatively low. The currency is at its weakest

level since the late 1990s, measured in real terms.

So far, the

Mexican economy has benefited from its

proximity to the US economy. This should continue if

the US economy is mid-cycle. In December, however,

Mexico’s policy strategy was put to a significant test as

the US Federal Reserve decided to raise policy rates by

25 basis points. Further down the road, this will slowly

make the US economy late-cycle (the United States