Insight Perspectives

Insight Perspectives

14

accounts for 80% of Mexican exports). The Mexican

central bank was therefore forced to act immediately

by

raising its policy rates by 25 basis points as well to 3.25% .In the near future, China, could also create headwind to

Mexico. This is the case as Beijing appears to be on a

path of more yuan depreciation. China cannot sit tight,

having seen the yuan appreciate strongly against all

other currencies in the last five years at the same time

as overcapacity and overleverage have become more

pronounced on the mainland – read more in the

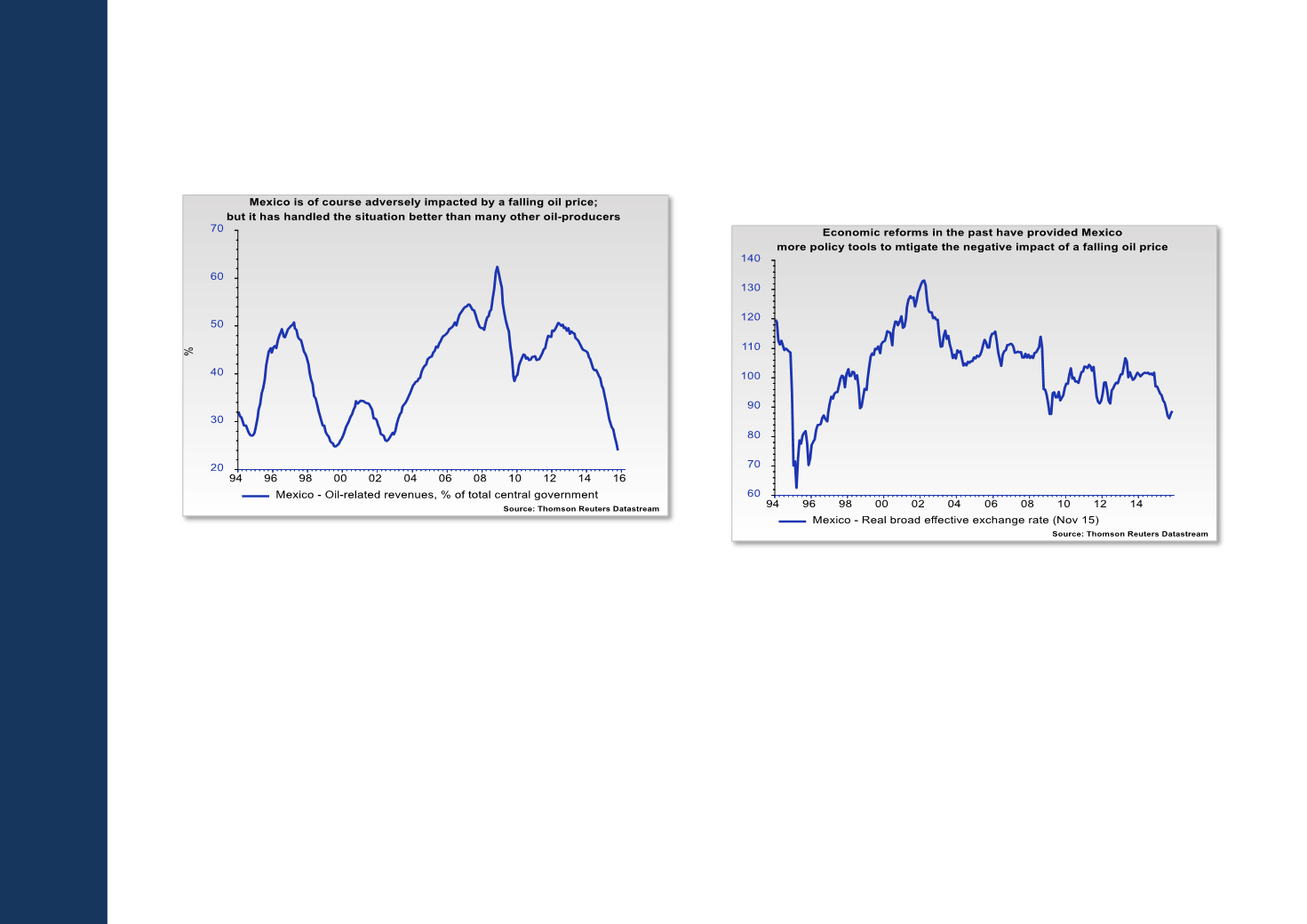

China section .Even though the Mexican government has pursued a

prudent strategy in the last few years and this has

made policy-making more flexible, there is no doubt

that global headwind is gaining momentum. Recently,

the Mexican central bank has tried to stem the decline

of the peso by intervening in the foreign exchange

market.

These efforts, however, will not be efficient at the same

time, since until recently the central bank added

liquidity to the domestic market. Indeed, Mexico may

soon acknowledge that it may not even be enough just

to mirror US monetary policy; a sharper rate hike may

be required. On the other hand, this will make the

Mexican peso even more attractive; the currency is

already undervalued!

Front page – Table of Contents