Insight Perspectives

Insight Perspectives

18

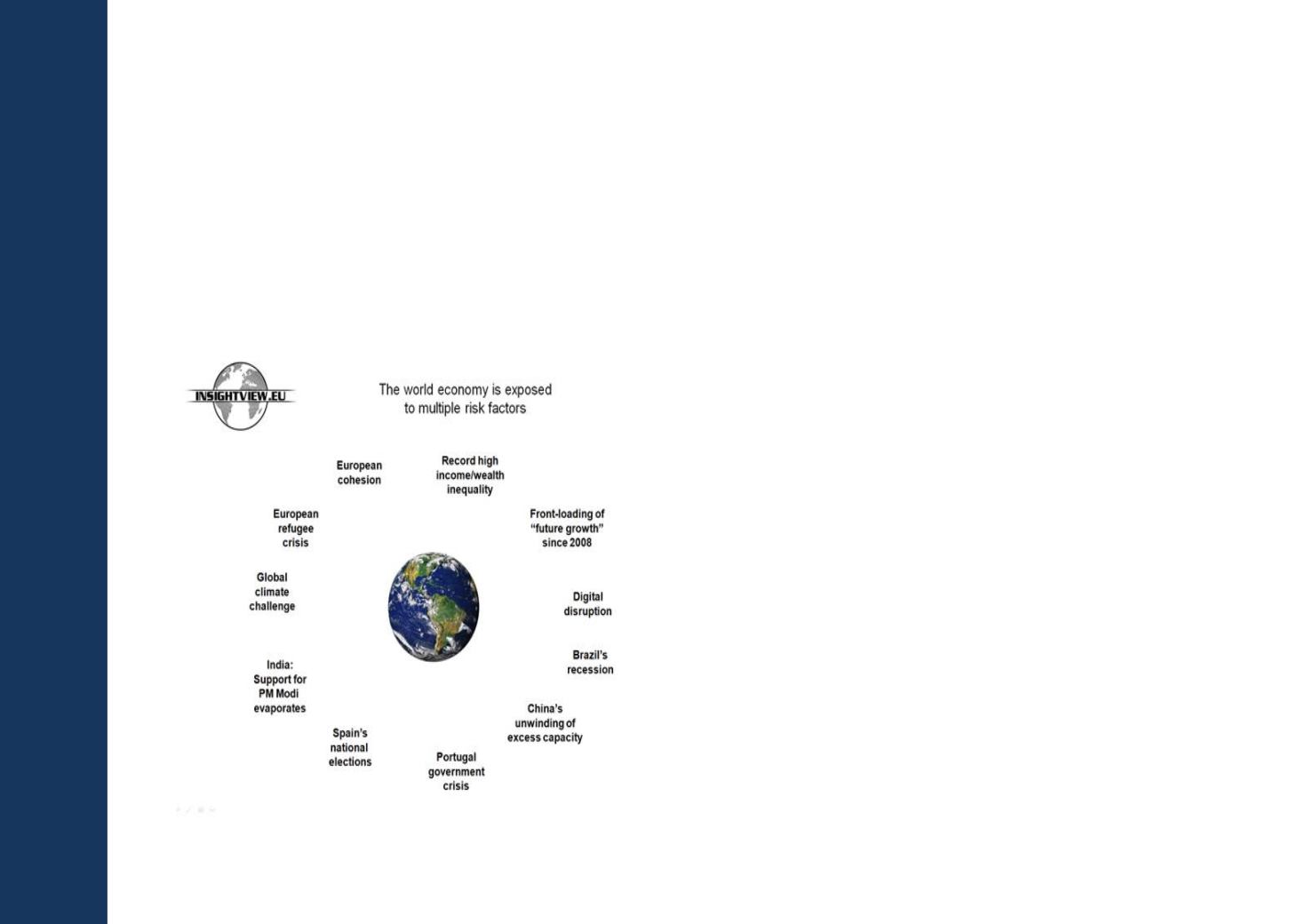

Unfortunately, the factors pose a risk to global growth,

which is also reflected in the 2016 Global Growth

Forecast - see the next page. Granted, the political

factor is often ignored by many investors and corporate

leaders; the timing and size of its impact is simply too

difficult to measure, they argue. This may be true; on

the other hand, it is not difficult to map a political

storyboard in Europe, which will give rise to more

serious political tensions in the coming years.

This would be bad news as many developed countries

cannot afford the economy coming to a standstill, since

they have used all monetary ammunition to create the

latest recovery. Indeed, since 2008, the developed

countries have front-loaded “future growth”, which will

be missing in the coming years. Furthermore, fiscal

policymakers in the same countries have seen their

fiscal debt situation continue to deteriorate, which

makes them even more vulnerable.

THE ECONOMY

In the short run, the

US economy

is still exposed to

significant tailwind from very low interest rates and

benign inflation. This, however, may soon come to an

end as the US Federal Reserve appears now to have

begun a long overdue monetary tightening process.

This will make the yield curve flatten, which is a

harbinger of slower growth from mid-2016.

Indeed, higher policy rates will turn the US economy

into a late-cycle economy. On the other hand, there are

no visible signs yet of an upcoming recession in the

United States. Granted, the manufacturing sector is

probably in recession, but this sector accounts for less

than 15% of GDP.