Insight Perspectives

Insight Perspectives

21

proves right that China will allow its currency to

depreciate more significantly in the first quarter of

2016.

THE COMMODITY MARKET

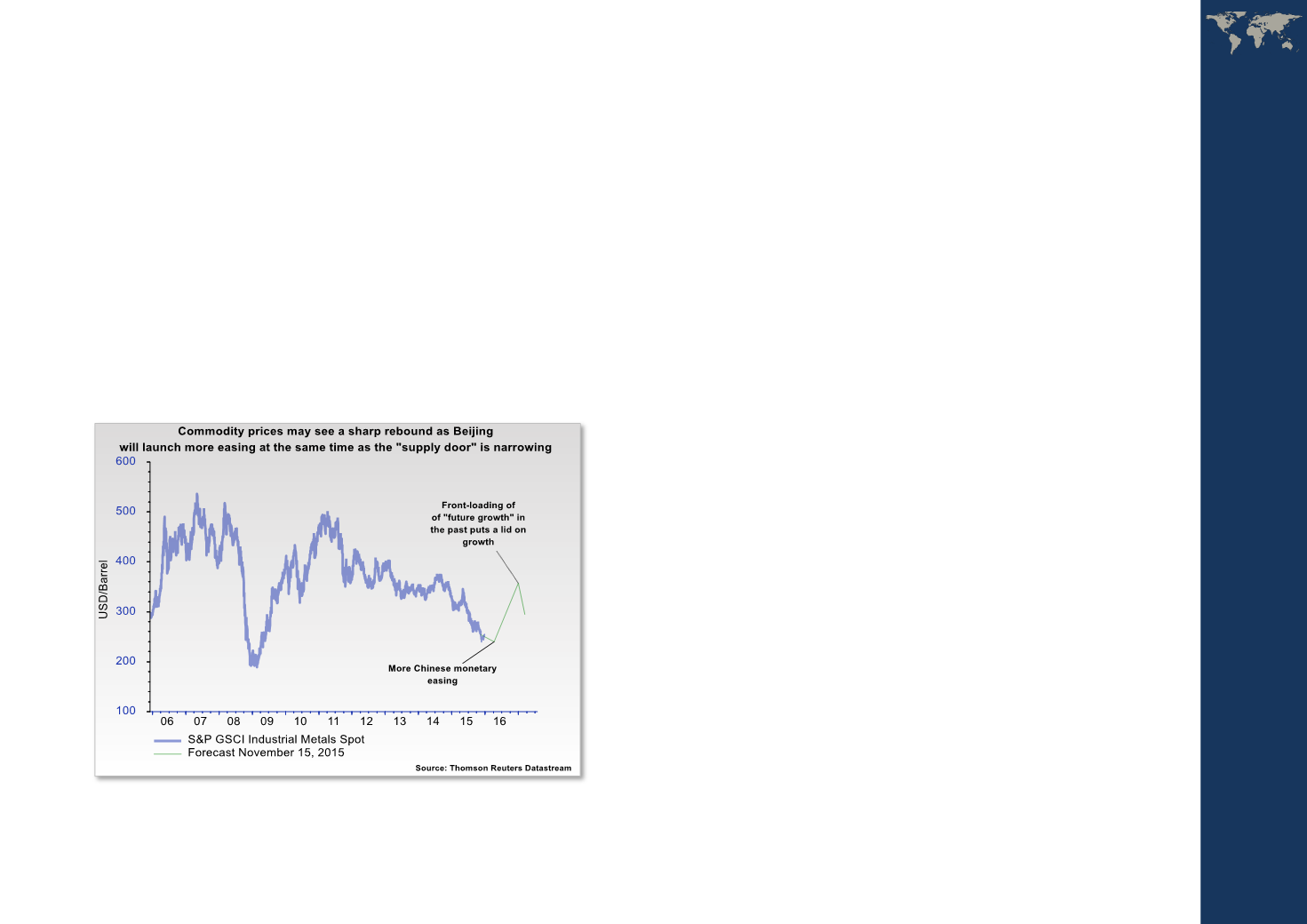

In the commodity market, the “supply door” is

narrowing as the mining sector has seen a steep decline

in capital expenditure in the last few years. At least, this

is the case in the non-energy sector and may soon be

the case in the oil market, although here

international politics play a far bigger role .Further down the road, this could create the right

conditions for a sharp rebound in commodity prices,

when demand regains momentum. The latter,

however, requires that China launches more aggressive

stimulus measures, which is also part of

Insightperspectives’ storyboard for 2016. The situation

in the oil sector, however, is far more complicated as

Saudi Arabia still shows no signs of intending to end the ongoing price war- read also the article,

The game plan of president Putin matters to the global financial market - not least when it comes to the oil price .THE STOCK MARKET

In the 2016 Outlook, the US economy is perceived to be

late-cycle although this is based on the forecast that

the US Federal Reserve will continue to raise policy

rates and the dollar stays strong. Such an outcome will

be a drag on the US stock market.

The perception that the European economy is seen to

be mid-cycle is not expected to benefit the European

stock market that much due to rising political tension

caused by the refugee crisis. This risks turning the

European stock market into a “value trap”. Granted,

this is a call not without risk, as the European economy