Insight Perspectives

Insight Perspectives

23

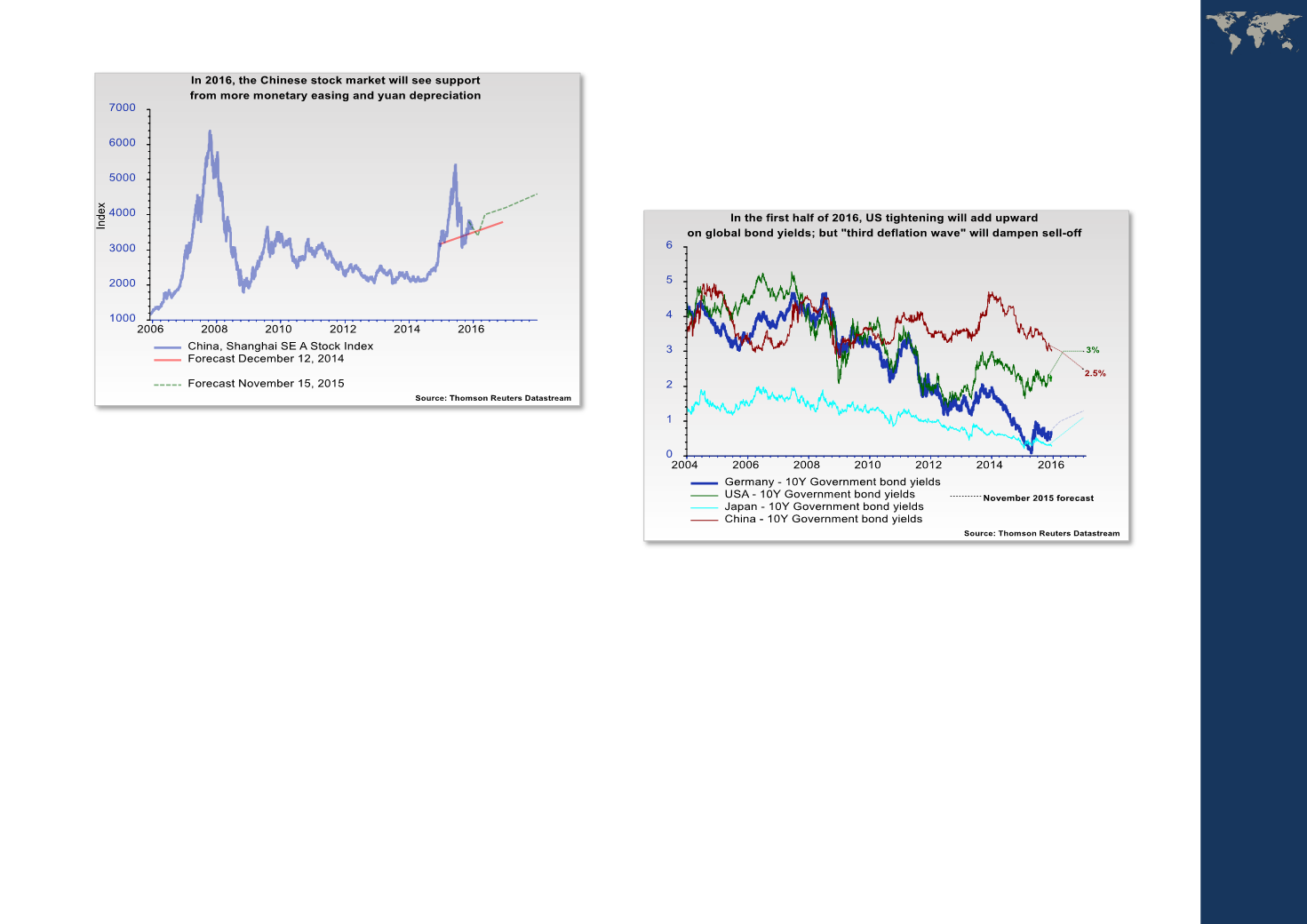

THE INTEREST RATE MARKET

At present, Insightperspectives does not expect any

dramatic changes in interest rates with the exception of

China. In the developed countries, government bond

yields are expected to increase slowly, not least in the

United States as the Federal Reserve is finally

anticipated to raise policy rates. The biggest impact

from the latter is probably felt in other asset classes

than bonds and particularly outside the United States.

In China, however, interest rates could decline sharply

as Beijing may already be on a path of money-printing

(quantitative easing), which will put downward

pressure on the Chinese yuan. The latter risks releasing

more deflationary pressure in the global economy,

which will put a cap on bond yields in the developed

world.

THE FOREIGN EXCHANGE MARKET

In 2016, volatility in the currency market is expected to

increase sharply as an increasing number of investors

will try to find shelter in “safe currencies”. This will not

be easy as the global currency war is expected to gain

momentum when it becomes clear that Beijing can no

longer afford having the world's economic problems

rest on its shoulders.