Insight Perspectives

Insight Perspectives

22

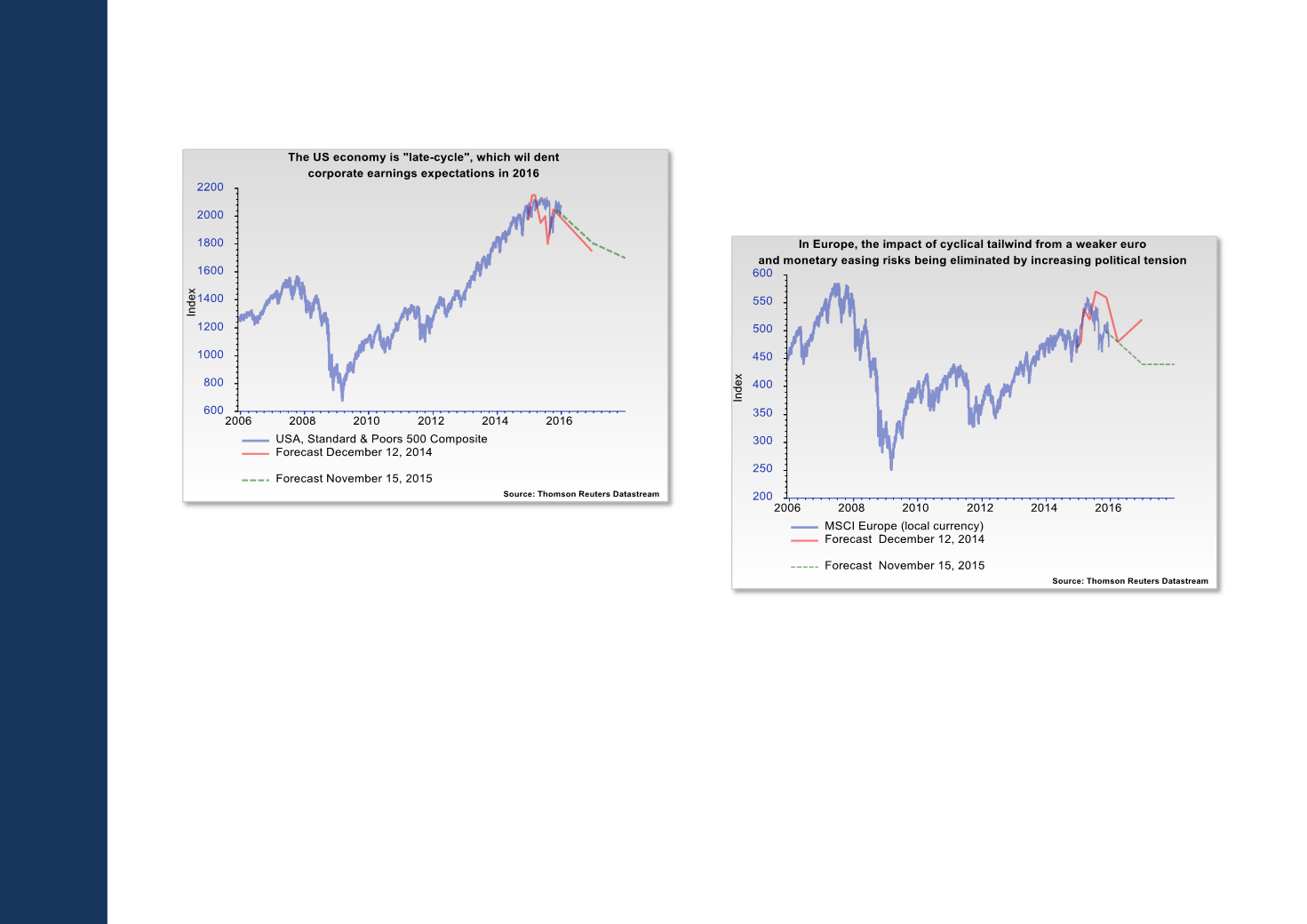

is exposed to significant tailwind from ultra-loose

monetary policy.

Conversely, the factors needed to raise political

tensions in Europe exist as well. In the not too distant

future, the European Union may have to distribute

many more hundred thousands of Syrian refugees,

which will require a tougher stance by Brussels.

In Berlin, some politicians are even talking about

imposing "economic sanctions" on countries such as

Poland if they fail to comply - read the Bloomberg

article,

Hungary's Orban Says Germany Struck `Secret' Turkey Refugee Deal .Indeed, this is a perfect

environment

for

policy

mistakes

and

fatal

misunderstandings – read also The Guardian article,

Polish PM rounds on European parliament head over 'coup' remark .Indeed, the European stock market

stands in front of a very bumpy road in 2016!

In the developed countries, the Japanese stock market

in particular may be exposed to the biggest downside

risk. First of all, foreign investors are heavily exposed to

this market. In addition, increasing global market jitters

in 2016 may trigger yen repatriation, which could

strengthen the yen dramatically to the disadvantage of

the stock market.