The Federal Reserve's path of policy rate cuts and the implications for the bond market

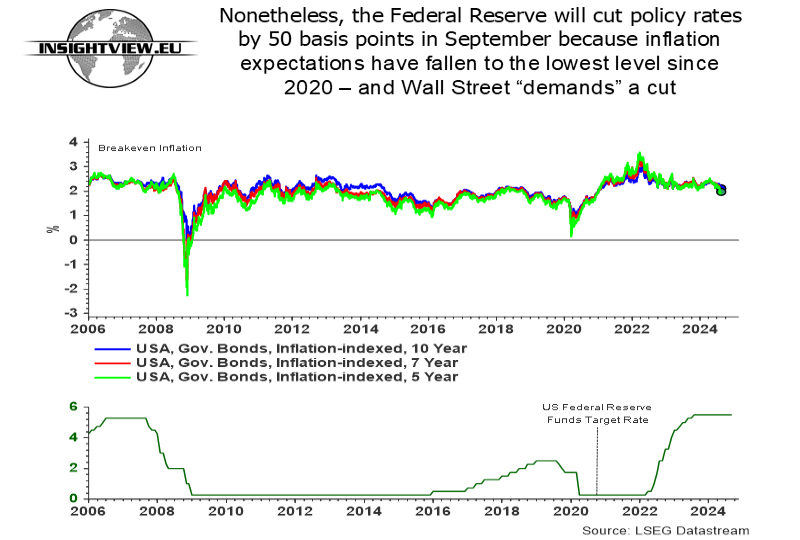

Insightview believes that the US Federal Reserve will

reduce policy rates by 50 basis points in September, maintaining a hands-off approach until after the presidential election. Simultaneously, the central bank is likely praying that Donald Trump, the greatest threat to US stability in over a century, does not return to power. Of course, the latter assertion is Insightview's opinion.

The magnitude of the anticipated rate cut suggests that the

central bank has suddenly fallen behind the curve due to recent turmoil in the stock market. The US Federal Reserve is well aware that when the stock market exhibits such movements, it can be an early indication that a

more significant correction may be on the horizon. This correction could happen within a week or at a later time. No one knows for sure.

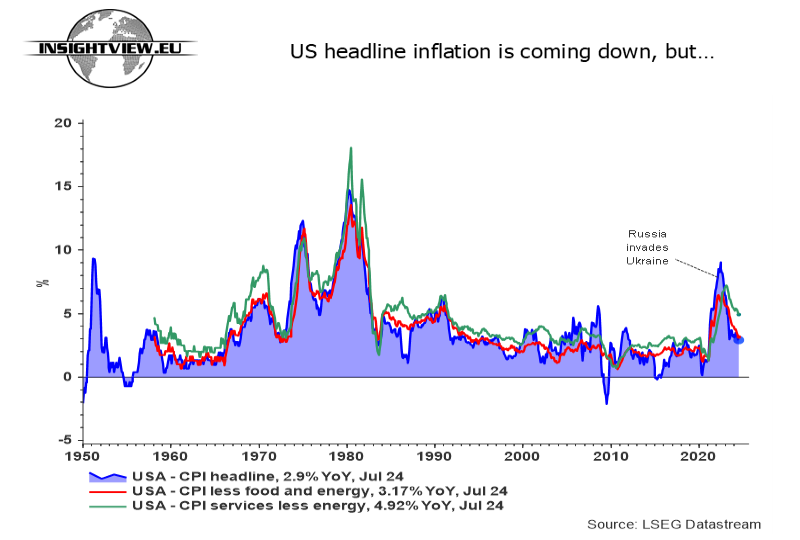

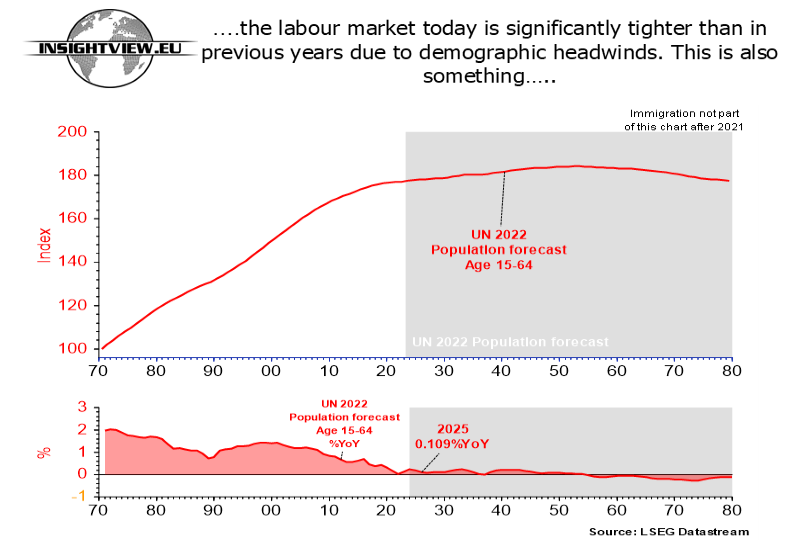

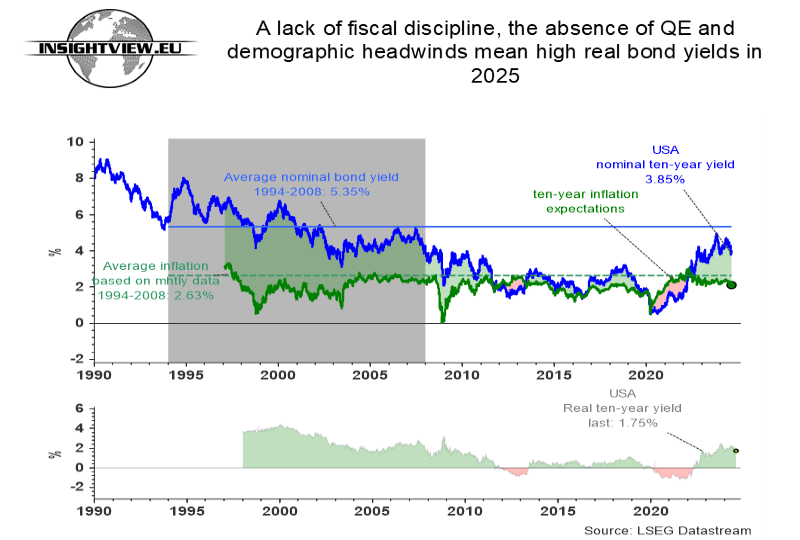

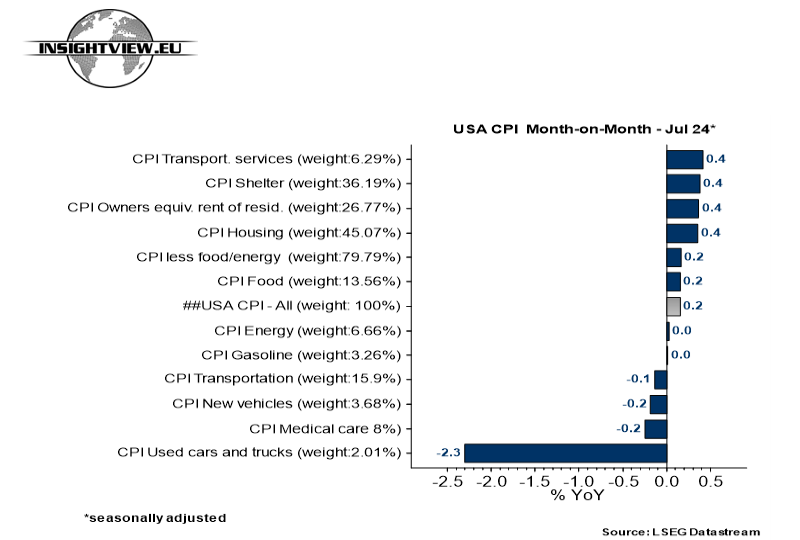

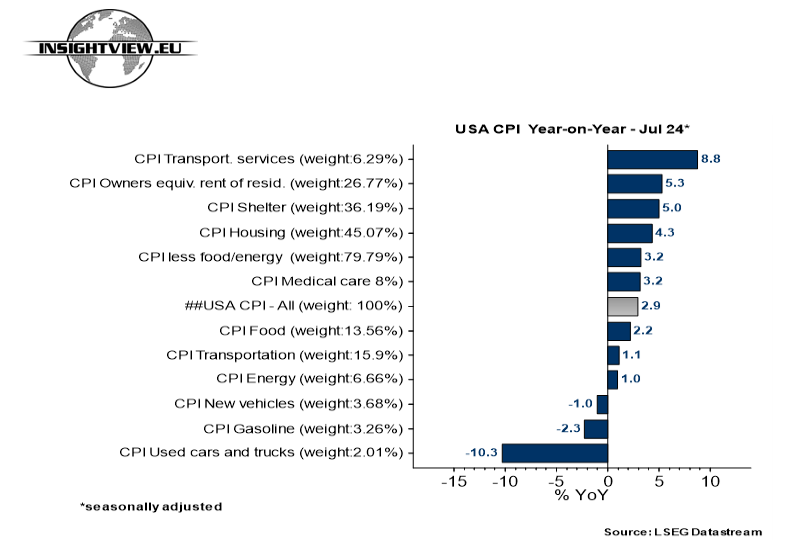

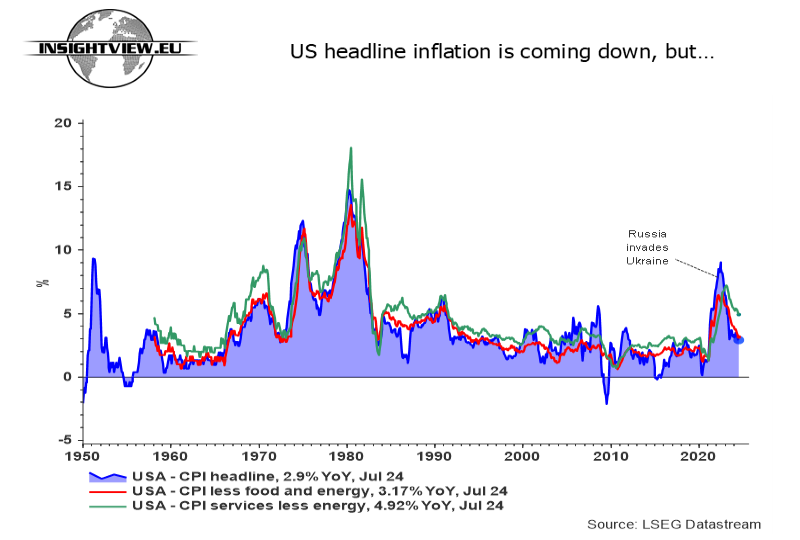

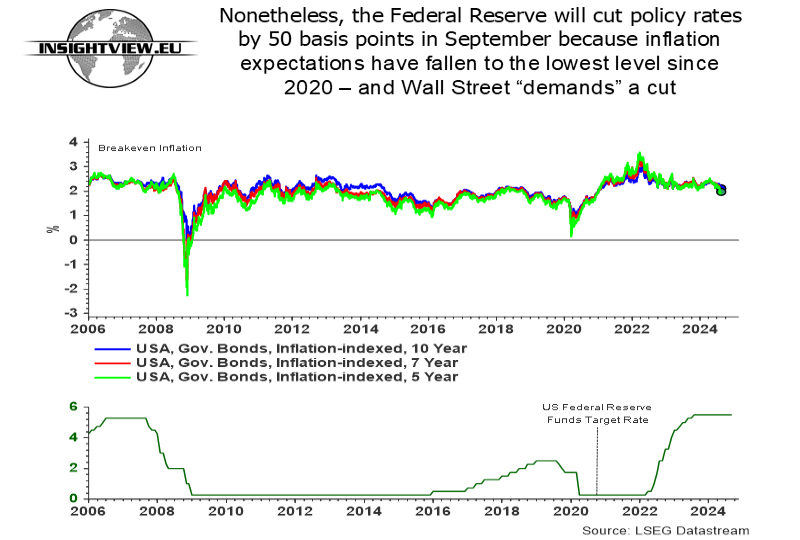

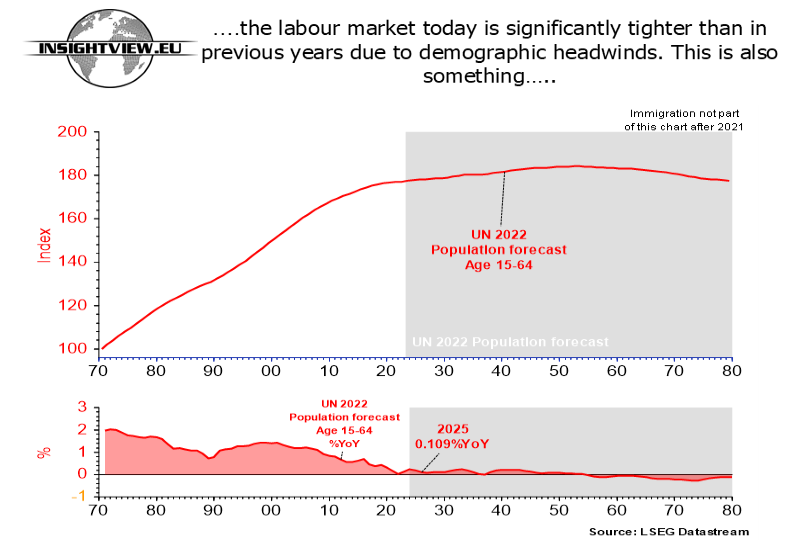

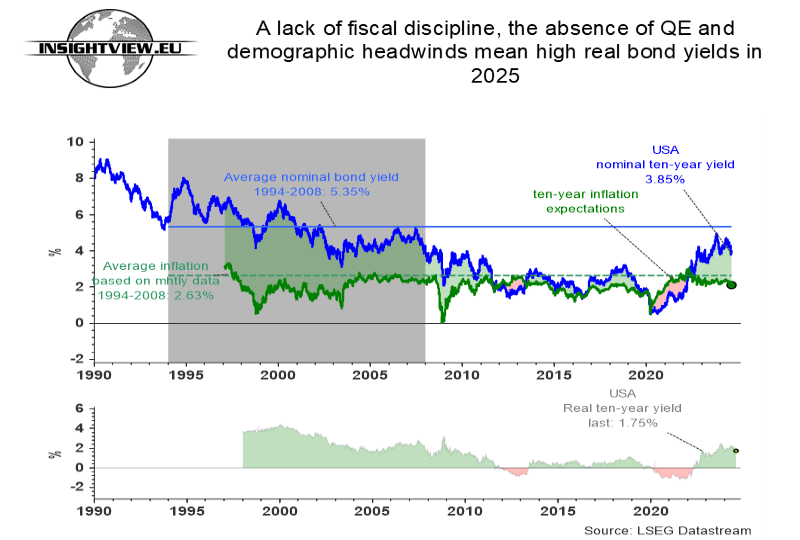

The central bank would like to get ahead of such a possible correction – especially as inflation expectations, as reflected in inflations-linked bonds, have significantly declined in the past few weeks. This concerns the central bank. However, the problem lies in the fact that it will be impossible for the Federal Reserve to fine-tune monetary policy, as the US economy is in a completely different place today compared to the past. Demographics, in particular, are poised to play a crucial role.

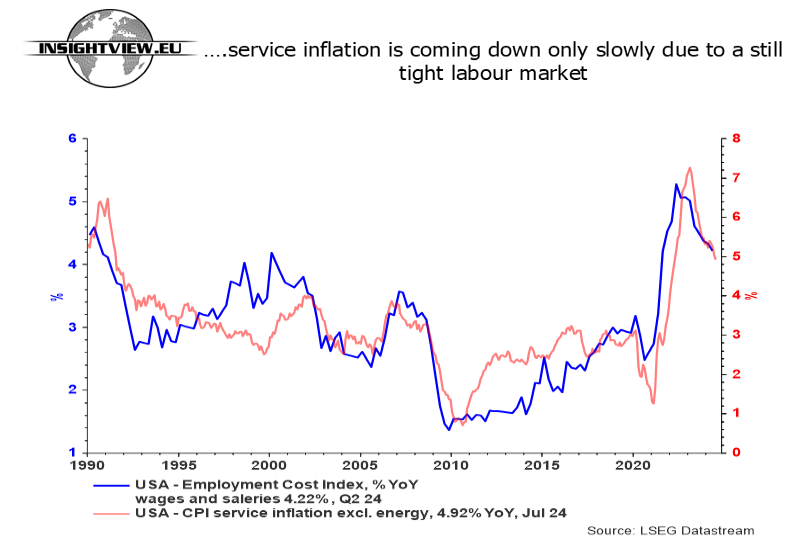

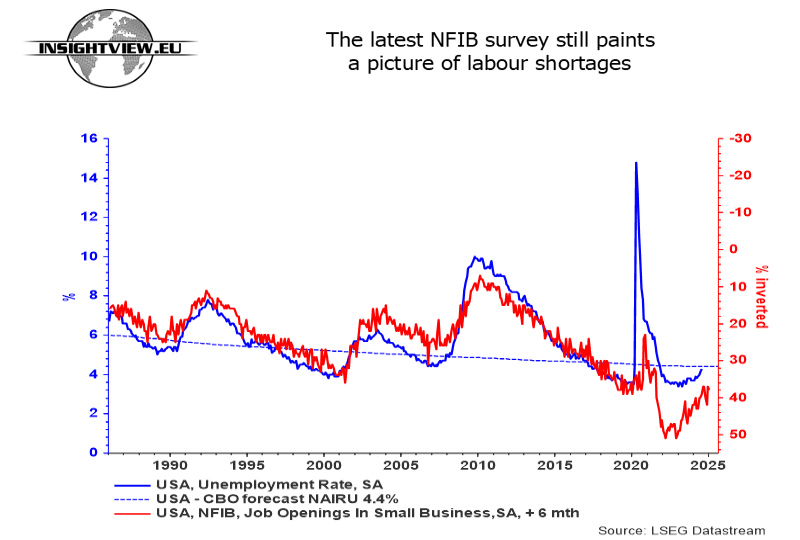

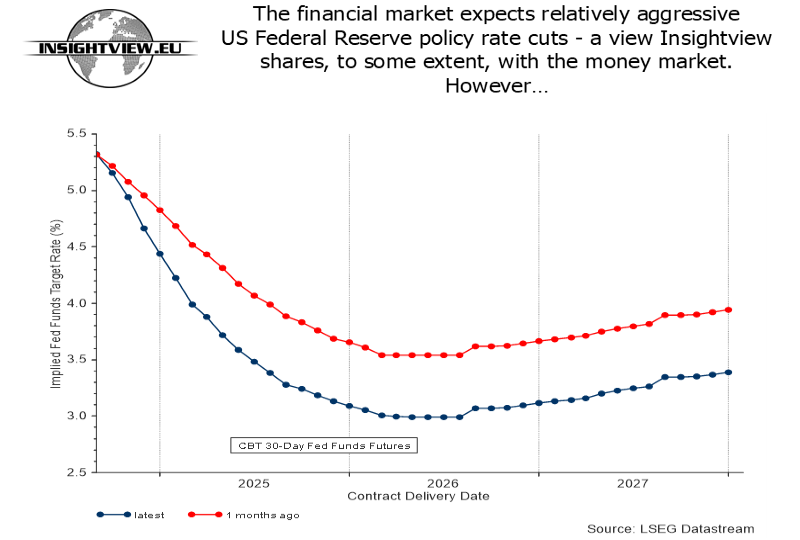

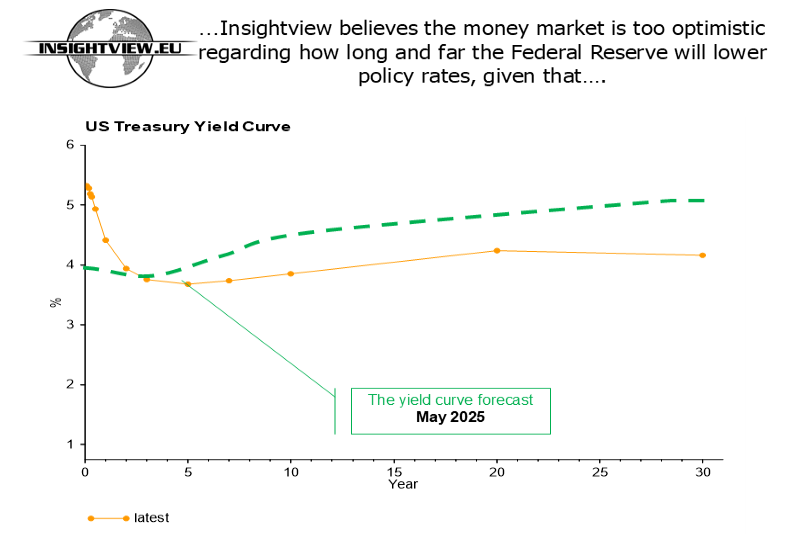

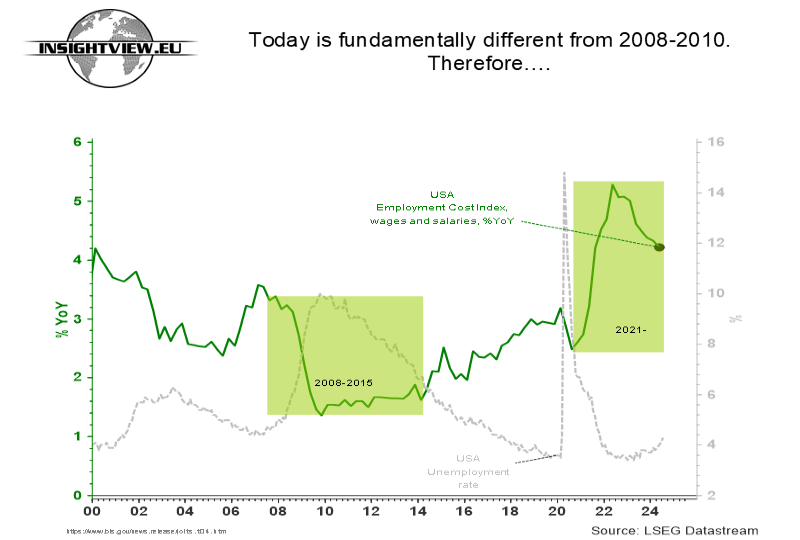

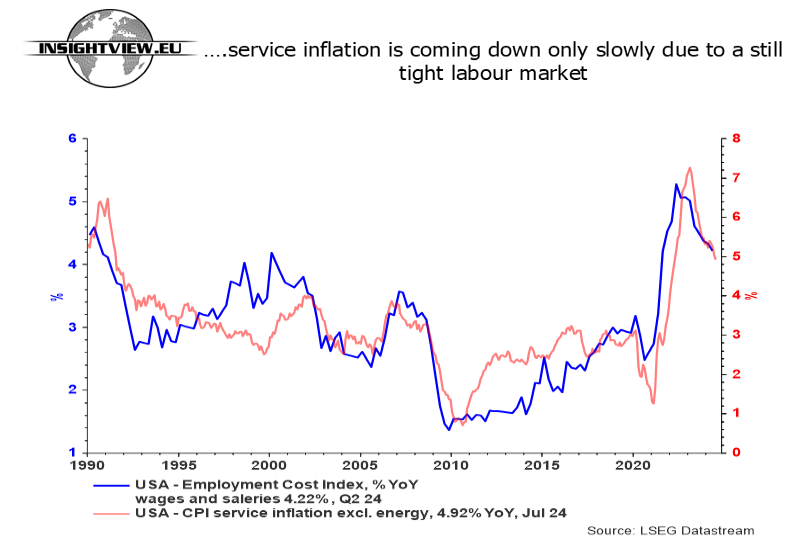

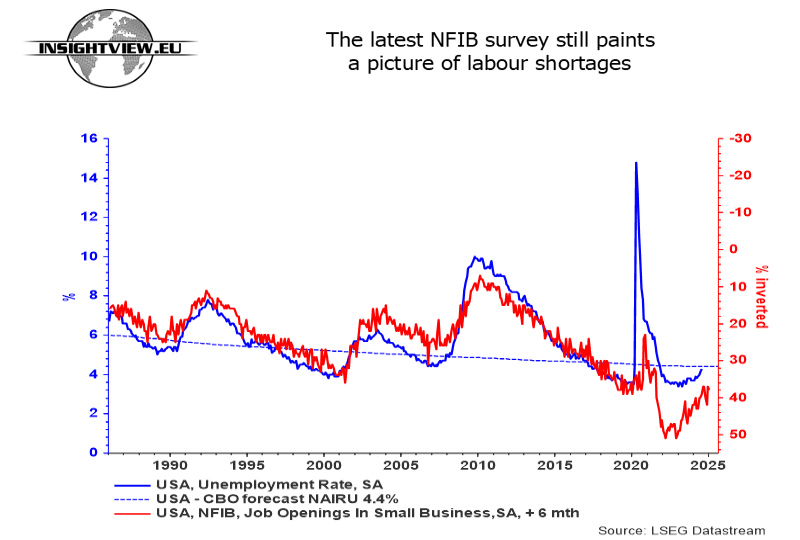

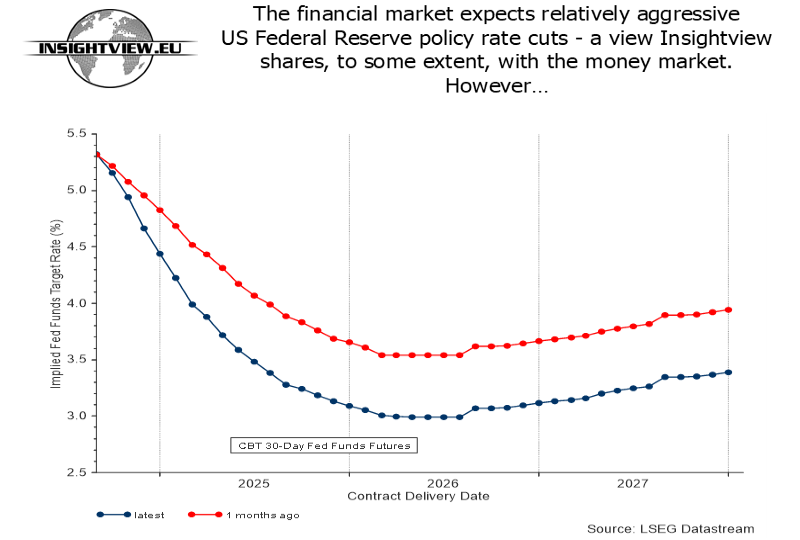

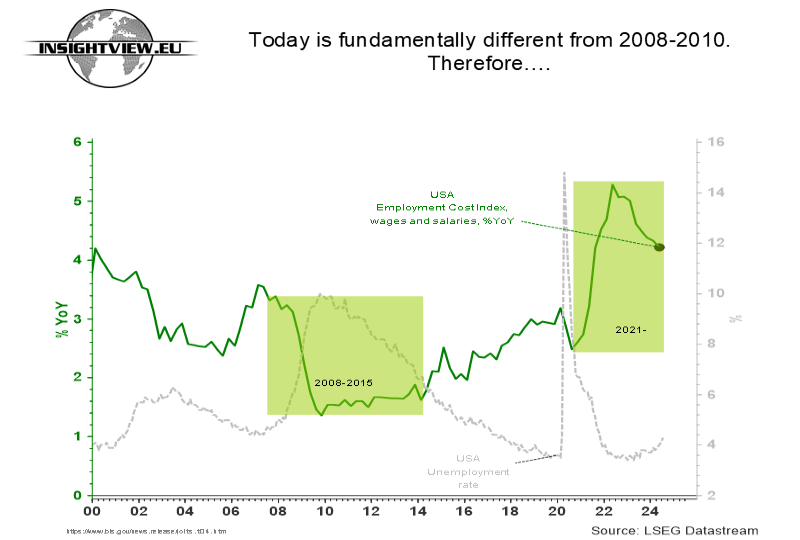

Monetary policy is undoubtedly too tight, given that inflation expectations [TIPS] have fallen to 2%. Therefore, the Federal Reserve is likely to reduce policy rates to around 4% by the second quarter of 2025, a view Insightview currently shares with the money market. However, this website believes the money market is too optimistic regarding how long and far the Federal Reserve will lower policy rates, given that the labour market today is significantly tighter than in previous years due to demographic headwinds.

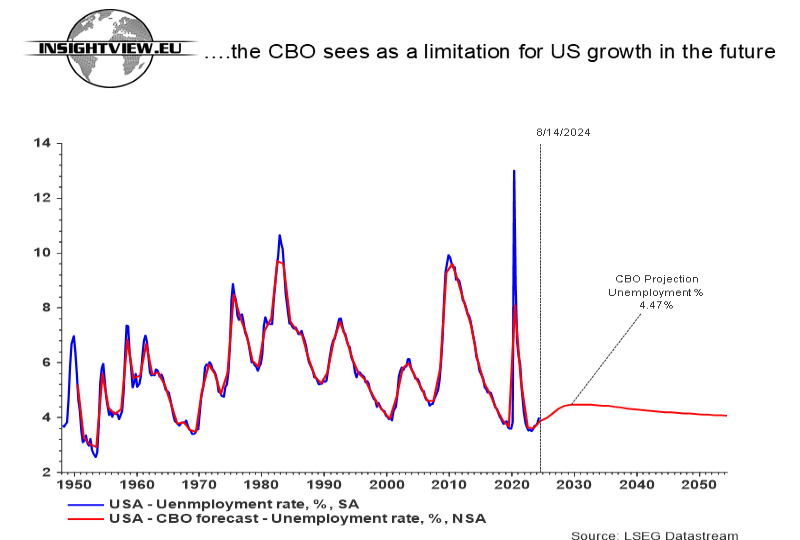

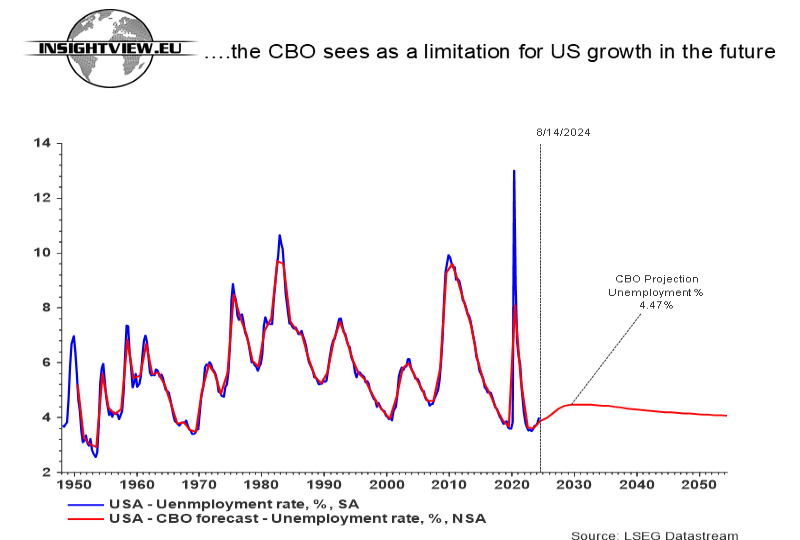

Such a conclusion is also reflected in the

Congressional Budget Office's projection for the labour market in the coming years, where unemployment is expected to stay below

NAIRU [see the charts below]. This suggests that a rate cut from the current level to 4% in the second quarter of 2025 could lead to a quicker decline in unemployment than in the past, as there is no longer the influx of younger individuals into the labour force that was seen previously – for example, in 2008-2010 – at least not to the same extent, unless the U.S. accepts a more substantial increase in immigration. While this might help fill low-skilled jobs, it does little to address the shortage of high-skilled workers.

The Political Landscape and Its Implications for Fiscal PolicyAt the same time,

nothing in the political landscape suggests significant support for a major fiscal tightening after January 20th—especially not if Kamala Harris wins the presidential election. The Democratic presidential candidate has moved further to the left, selecting Tim Walz as her running mate. This also means increased social spending.

On the other hand, Donald Trump in the White House would result in domestic and foreign policy chaos, which Insightview believes is not desirable. Additionally, a new Trump administration would undoubtedly mean unfunded tax cuts. Thus, the upcoming election presents a

choice between who will cause the least harm to the United States and the rest of the world. The uncertainty surrounding fiscal discipline makes it unlikely that the US central bank will sponsor fiscal stimulus measures in the form of quantitative easing. The central bank can "refuse" with a Democratic president but

not with Donald Trump at the helm.

From a broader perspective, the above scenario also suggests that neither a Democratic nor a Republican president will focus much on price stability. Furthermore, it shows limited budgetary room for surprises in the form of new military conflicts in the world, which the US could—and likely will—be drawn into in the coming years.

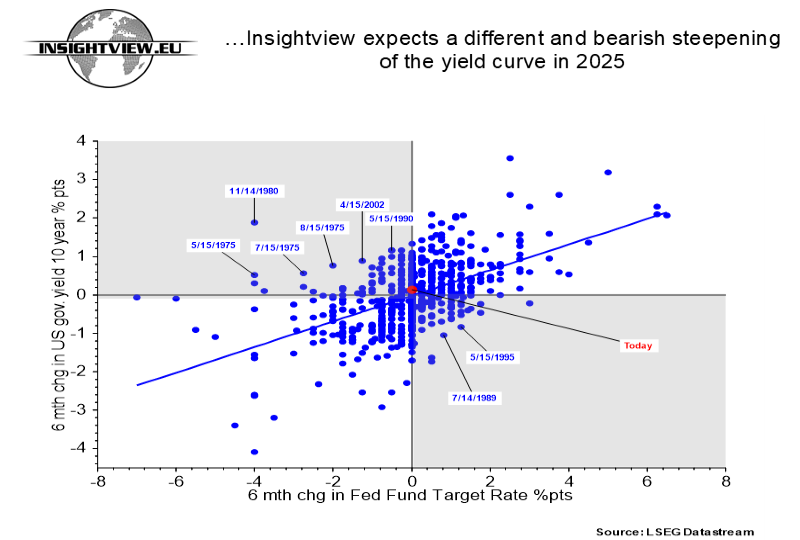

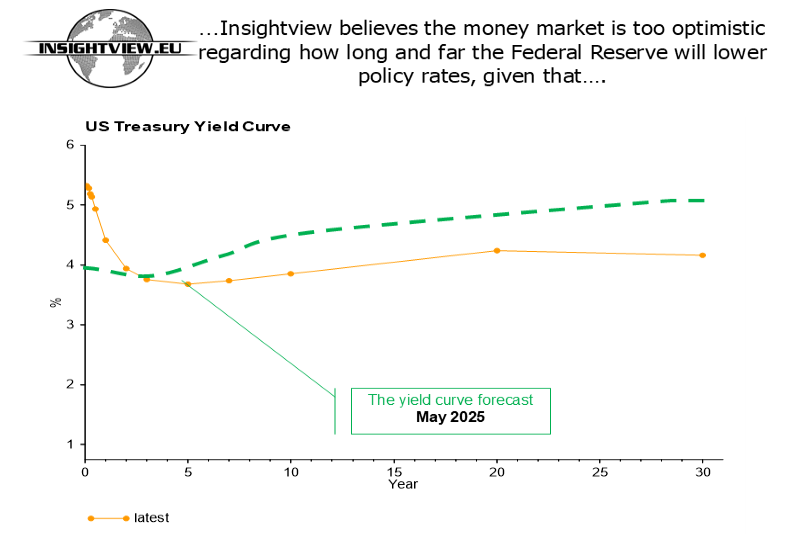

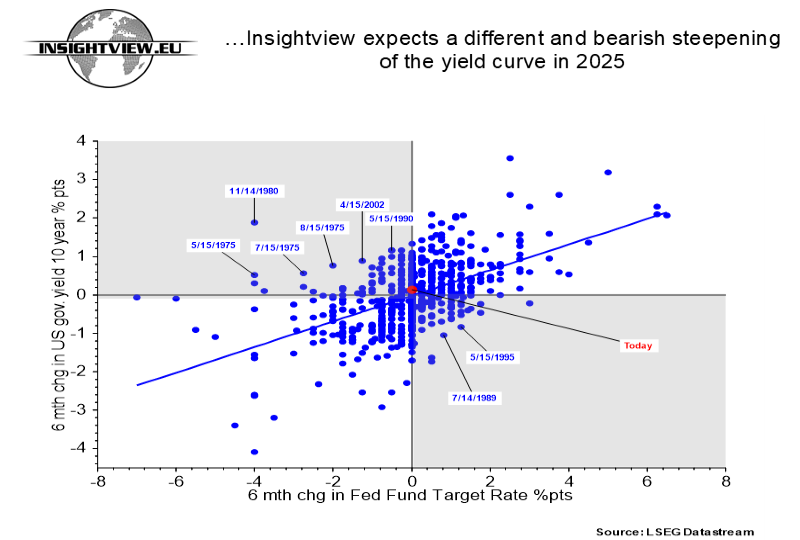

The Uncertain Path Ahead and the Yield CurveAccording to Insightview, the above factors underscore why the bond market will view the upcoming policy rate cuts more sceptically than in previous monetary easing periods. Consequently, this will lead to a "bearish steepening of the

yield curve" [read the Insightview article,

A steepening US yield curve 'assumes' the Federal Reserve will do the 'right thing.' A robust NFIB survey shows why this will not be a classic economic slowdown]. The US - and the Eurozone - need a significant increase in unemployment to curb wage increases unless we see an unprecedented rise in productivity, potentially driven by factors like

Artificial Intelligence. While such an

AI-driven rise in productivity is expected to occur in the future, it is unlikely to happen in 2024, 2025, or even 2026.

14. August 2024 - Weekly Update - August 15, 2024

13. August 2024 - A steepening US yield curve 'assumes' the Federal Reserve will do the 'right thing.' A robust NFIB survey shows why this will not be a classic economic slowdown

9. August 2024 - The impact of AI on the US economy: Is divergence between SP500 market cap and nominal GDP too high?