Inflation: Why the focus should shift 'permanently' from inflation to real bond yields

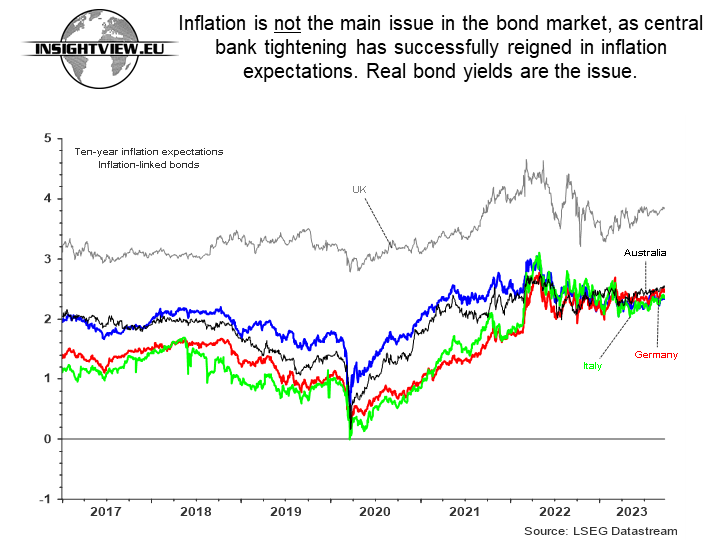

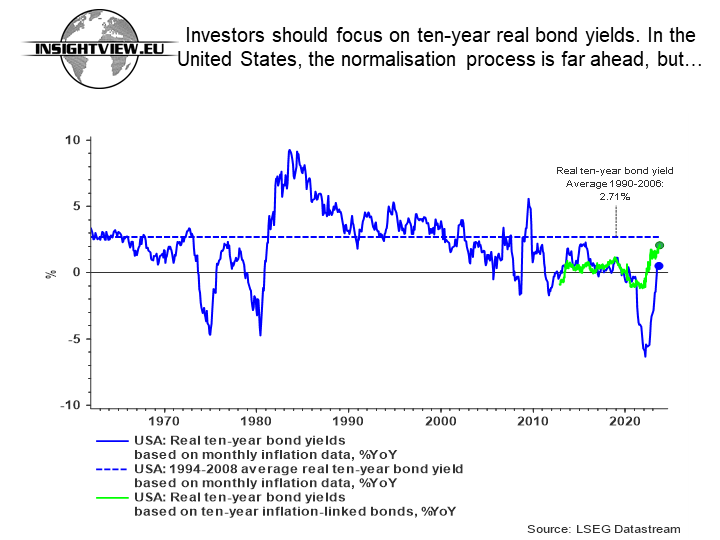

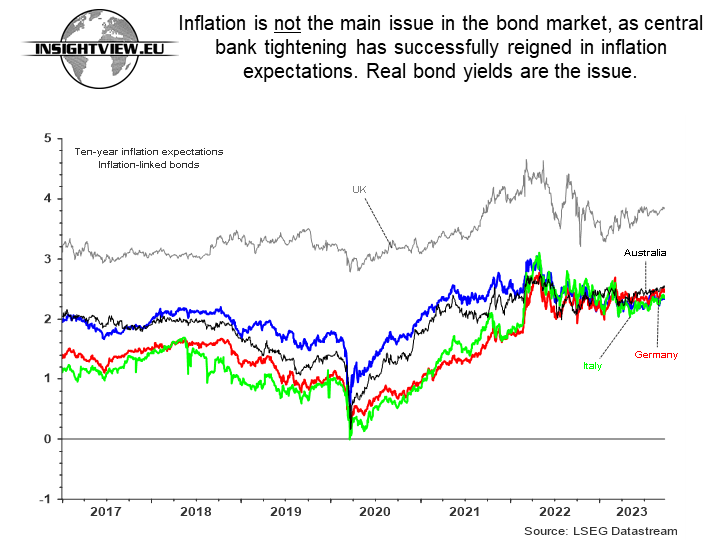

Financial media and analyses are awash with discussions about falling inflation and its potential impact on monetary policy. Insightview, however, contends that inflation is not the real issue unless we encounter demand-driven deflation, which central banks must - of course - address. Currently, that's not the case. The primary

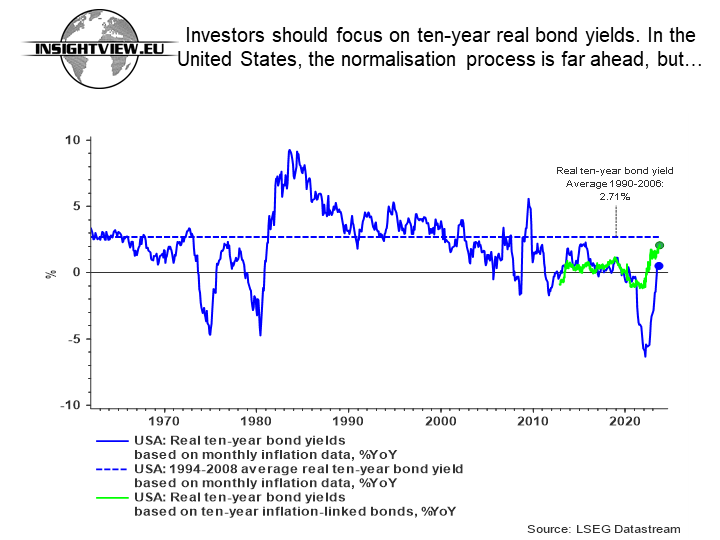

focus should instead be on real yields at the long end of the bond market, which is driving the rise in nominal bond yields.

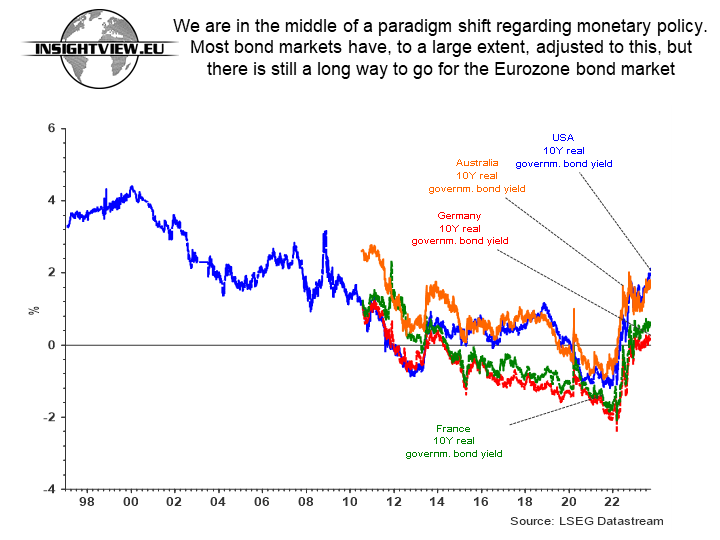

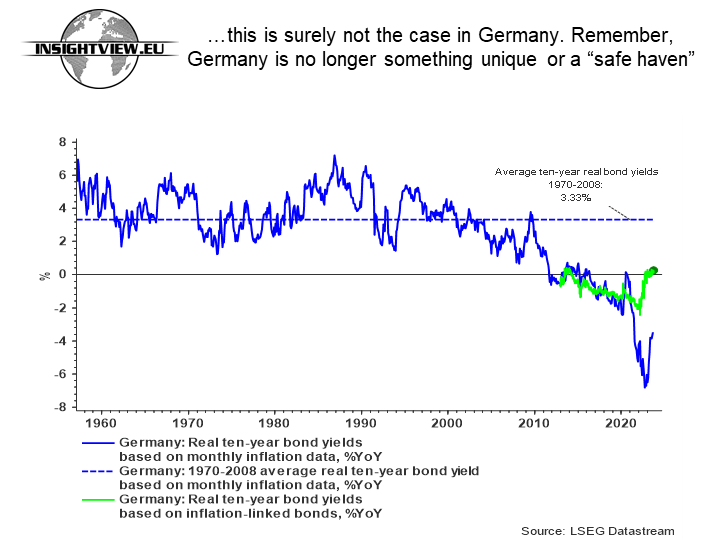

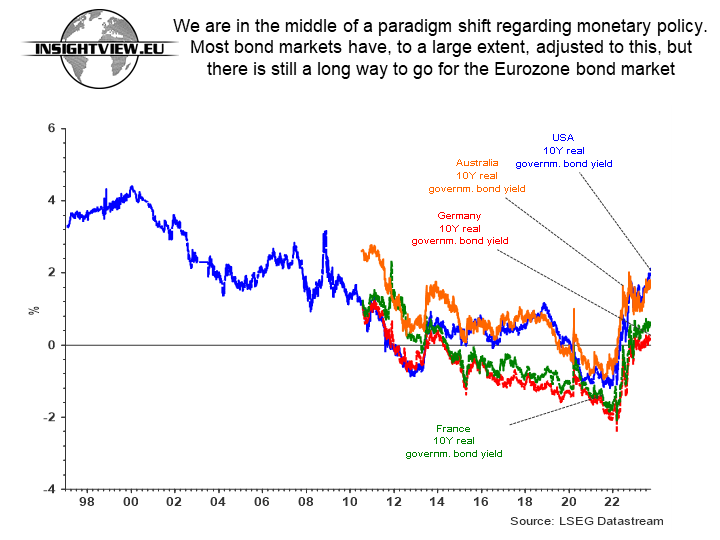

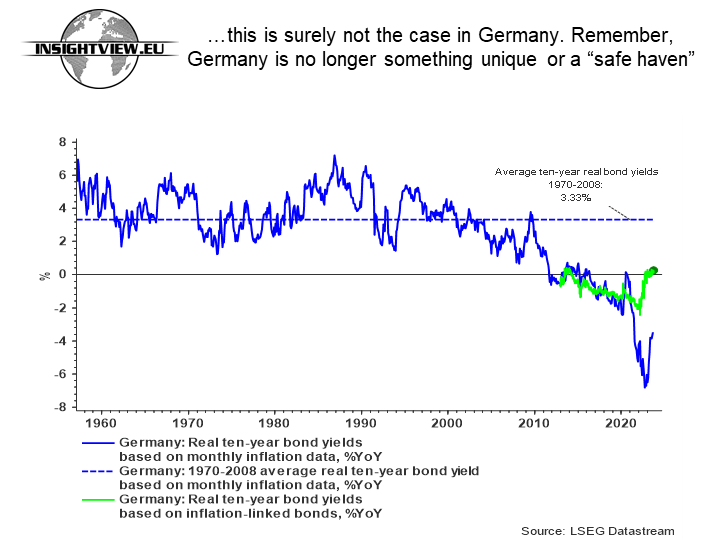

In the Western world, monetary policy and real bond yields are undergoing a normalisation process because we are in an entirely different geopolitical and demographic environment. The process is lagging in the European Union, mainly because liquidity-dependent investors still believe that the European Central Bank hasn't changed. The fact is, it has - drastically constrained by

shifts in geopolitics and demography.

The decline in monthly inflation statistics in the Western world is primarily a result of the base effect from historically high energy prices a year ago - and, of course, a sharp decline in energy prices back to the starting point. Additionally, we are witnessing the consequences of one of the fastest-ever monetary tightenings, albeit from a historically lax starting point due to a decade of "money printing", which priced assets based on free access to money. Conversely, today, we are in the midst of a monetary normalisation process.

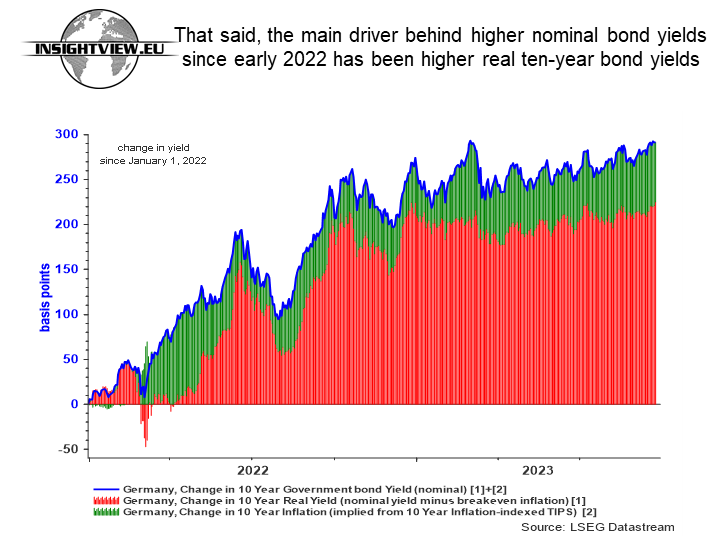

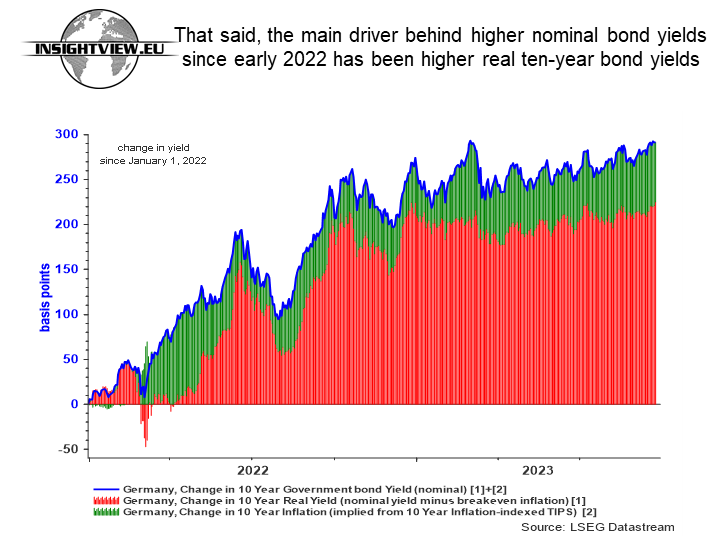

At first glance, the drop in inflation - based on monthly consumer price statistics - hasn't surprised the bond market, at least if one considers nominal bond yields in the EU and the US have risen in 2023. However, the yield increase is solely due to soaring real bond yields - based on inflation-linked bonds. According to ten-year inflation-linked bonds, bond investors'

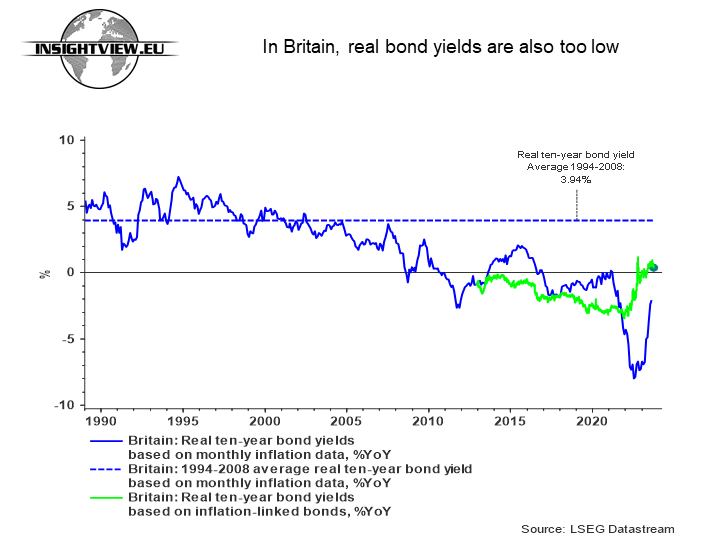

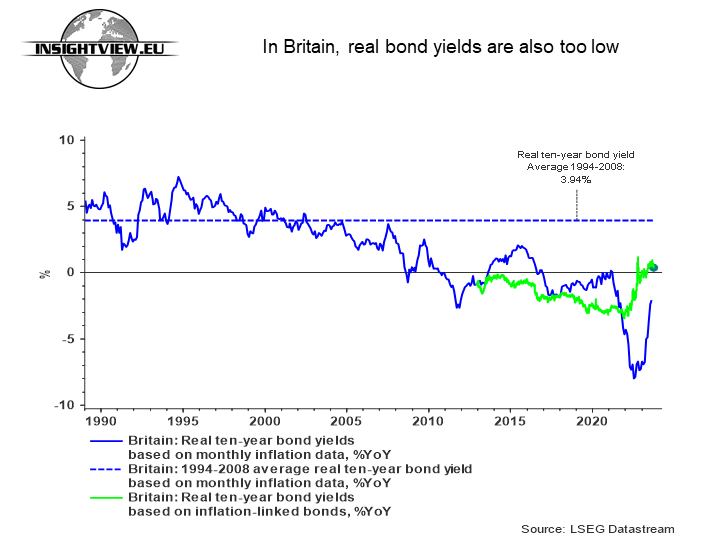

long-term inflation expectations in the Eurozone and the United States remained relatively stable at around 2.0% to 2.5% in 2022 and 2023 [see the charts below]. The exception is Britain, an "economic maverick", where the Bank of England Governor seems more adept at offering excuses than managing monetary policy.

Today, bond investors want higher real bond yields because they know more issuances are coming. There is a growing awareness within the ECB and the US Federal Reserve that easing monetary policy makes little sense in an era of secular labour shortages and numerous "tied-up tasks" in the public sector in the form of rising defence spending, energy investments, subsidies, and healthcare costs related to an ageing population [see the Insightview

Macroeconomic and Political Update Web Presentation].

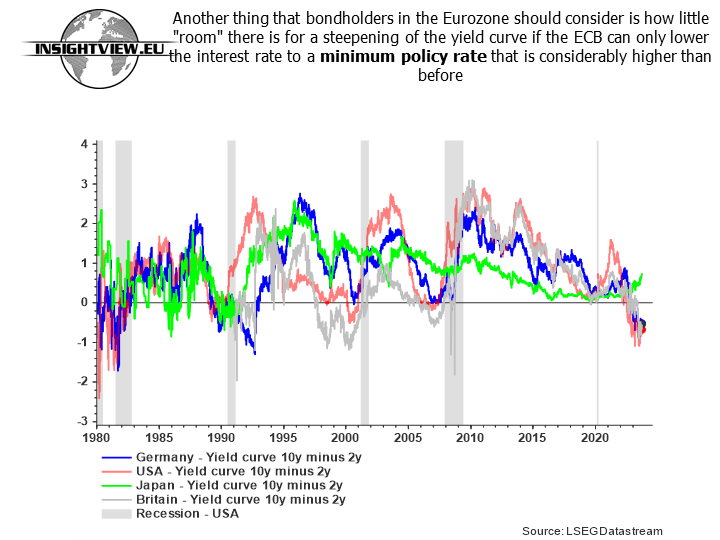

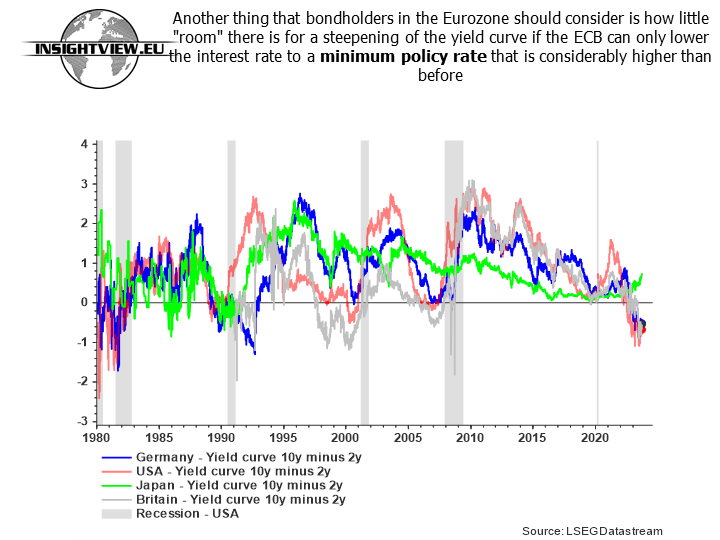

This doesn't mean the ECB and the Federal Reserve won't lower policy rates if unemployment rises excessively. However, due to secular headwinds from demographics and geopolitics, we won't see the same extent of monetary easing as before. Consequently, the

minimum policy rates will be higher in the future than in the past decade. If so, this will have huge consequences.

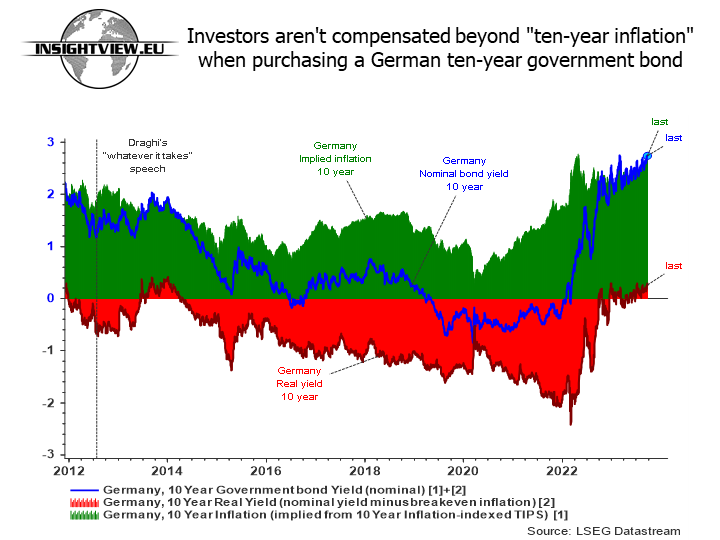

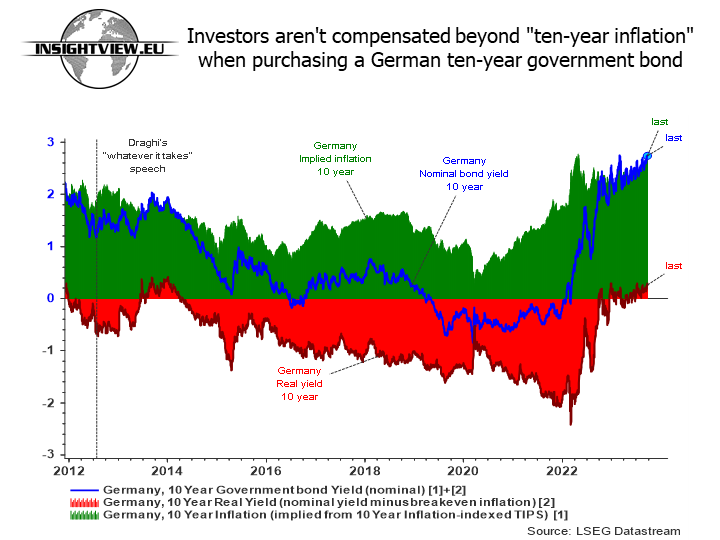

If the readers of this article accept such a premise - that central banks might lower policy rates during an economic slowdown, but not as much as before - it follows that there is limited or no potential for a decrease in long-term bond yields. In this light, one could argue that the Eurozone's ten-year real bond yields - based on inflation-linked bonds - are far too low. Investors aren't compensated beyond "ten-year inflation" when purchasing a German ten-year government bond.

Another thing that bondholders in the Eurozone should consider is how little "room" there is for a steepening of the yield curve if the ECB can only lower the interest rate to a

minimum policy rate that is considerably higher than before - unless long-term bond yields do not fall (or even rise) during a period of policy rate cuts.

A still low ten-year real bond yield in the Eurozone - based on inflation-linked bonds - suggests that many investors still believe - after more than a decade awash with liquidity - that the ECB might revert to its old pattern of "doing whatever it takes". Insightview disagrees that the ECB will revert to its old ways. Given the drastically altered demographic and geopolitical landscape, this website has often argued that the ECB and the US Federal Reserve can't afford to. Conversely, should central banks succumb to the temptation to revert, it would be detrimental for the long end of the bond market, as the secular headwinds will only intensify in the coming years, making such a monetary U-turn highly inflationary.

22. September 2023 - Is the EU acting according to its size? Paris-Berlin aims for a 'multi-speed Europe'

21. September 2023 - US Philadelphia Fed survey underscores a complex environment for the Federal Reserve. Inflation pressure increases, but the headline index declines

21. September 2023 - France's leading business survey reflects ECB's dilemma: The 'labour shortage problem' will not go away despite slower growth