19. September 2024

Killing of 10-year-old in Shenzhen rattles already shaky Japan-China ties - Nikkei Asia

19. September 2024

Ukrainian drone attack triggers earthquake-sized blast at arsenal in Russia's Tver region

19. September 2024

Stellantis faces unprecedented UAW strikes a year after national walkout

19. September 2024

Boeing furloughs thousands as no progress made to resolve strike

19. September 2024

Exclusive: US keeps missile system in Philippines as China tensions rise, tests wartime deployment

19. September 2024

The shapeshifter: who is the real Giorgia Meloni?19. September 2024 - Articles

The Federal Reserve did the right thing, but it gives food for thought in the bond market18. September 2024 - Articles

Podcast interview with Jacob Funk Kirkegaard, PIIE and Bruegel: Does the EU have what it takes to avoid falling further behind?17. September 2024 - Articles

Eurozone: Wage pressure will not disappear. The outcome of the VW labour conflict will be crucial for Germany and the entire EU. Intel cancels factory in Magdeburg13. September 2024 - Articles

China no longer has wise political leaders - but weak EU leaders continue to fall for old tricks in Beijing12. September 2024 - Articles

The Eurozone faces chaotic years ahead - and the ECB cannot help much this time. The AfD is looking forward to the 2025 election11. September 2024 - Articles

In the West, the risk of stagflation is likely more significant than the risk of recession

In 2015, foreign policy in the European Union and the United States has been “annus horribilis”, which was also outlined in last week's monthly newsletter, Insightperspectives (click the image on the right). To some, such as the far right in the Republican Party, this shows that being inactive (or withdrawing troops too early) endangers political stability. To others, today’s political mess in the Middle East and with that the refugee crisis in Europe are the consequences of too much foreign policy action in the past.

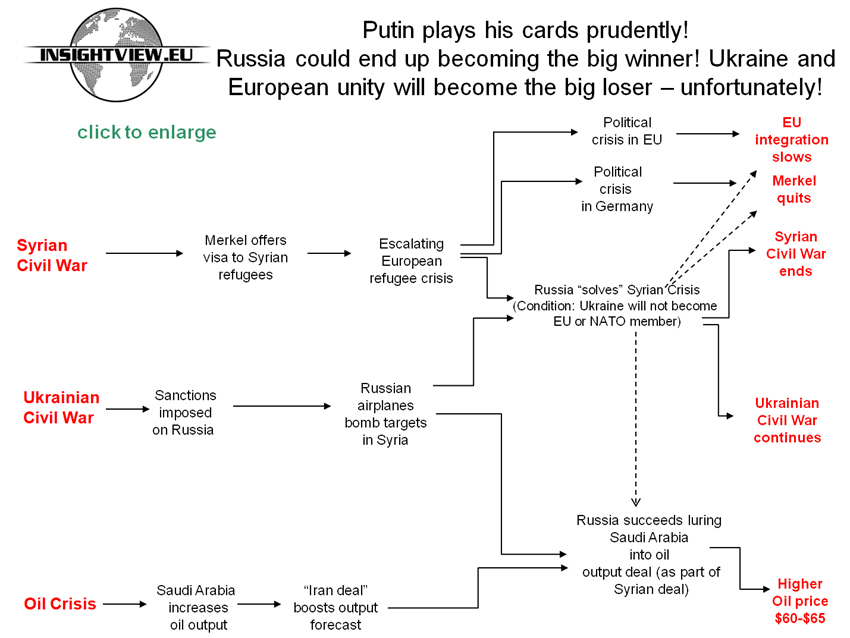

In 2015, foreign policy in the European Union and the United States has been “annus horribilis”, which was also outlined in last week's monthly newsletter, Insightperspectives (click the image on the right). To some, such as the far right in the Republican Party, this shows that being inactive (or withdrawing troops too early) endangers political stability. To others, today’s political mess in the Middle East and with that the refugee crisis in Europe are the consequences of too much foreign policy action in the past.  Russia's strategy will be walking a tightrope as Moscow needs to balance three highly integrated crises: The Ukrainian crisis, the Syrian Civil War and the Oil Crisis - click the image on the right or click here to see Putin's "road map". Moscow probably sees Syria as a tool for obtaining its ultimate goal namely to prevent Ukraine from becoming a member of the European Union and NATO. In addition, Mr. Putin's game plan may even succeed boosting the oil price, which is highly needed to mitigate the current economic downturn in Russia.

Russia's strategy will be walking a tightrope as Moscow needs to balance three highly integrated crises: The Ukrainian crisis, the Syrian Civil War and the Oil Crisis - click the image on the right or click here to see Putin's "road map". Moscow probably sees Syria as a tool for obtaining its ultimate goal namely to prevent Ukraine from becoming a member of the European Union and NATO. In addition, Mr. Putin's game plan may even succeed boosting the oil price, which is highly needed to mitigate the current economic downturn in Russia. When it comes to Syria, many players are involved - click the image on the right to read an interesting article from the Financial Times. President Assad (minority Shia) is supported by Iran (Shia) and Russia. Assad, however, is opposed indirectly by Saudi Arabia (Sunni) and Turkey (Sunni) via military support to different opposition groups in Syria (moderate Muslims and ISIS). The United States has also financed moderate opposition groups in Syria although this has been concluded to be a huge failure. Saudi Arabia is well aware that if Russia steps up military involvement in Syria, which seems to be the case, Riyadh's goal in Syria will not be achieved. Furthermore, there is no backing in Washington for another military adventure in the Middle East in front of presidential elections.

When it comes to Syria, many players are involved - click the image on the right to read an interesting article from the Financial Times. President Assad (minority Shia) is supported by Iran (Shia) and Russia. Assad, however, is opposed indirectly by Saudi Arabia (Sunni) and Turkey (Sunni) via military support to different opposition groups in Syria (moderate Muslims and ISIS). The United States has also financed moderate opposition groups in Syria although this has been concluded to be a huge failure. Saudi Arabia is well aware that if Russia steps up military involvement in Syria, which seems to be the case, Riyadh's goal in Syria will not be achieved. Furthermore, there is no backing in Washington for another military adventure in the Middle East in front of presidential elections.